In the thrilling world of stock markets, an IPO announcement often sends ripples of excitement among investors. The anticipation and subsequent allotment of IPO shares are moments that many eagerly await. However, amidst the thrill, a pertinent question often arises: Do I have to pay tax on IPO allotment?

Page Contents

Understanding IPO and Taxation

An Initial Public Offering (IPO) is the mechanism through which a private company offers its shares to the public for the first time, effectively entering the stock market. This process allows the company to raise capital by selling its shares to public investors. When individuals apply for an IPO, they receive an allotment of shares if successful.

However, the taxation aspect regarding IPO shares is crucial. Upon receiving an IPO allotment, it’s important to note that no immediate tax liability is incurred at the time of allotment since these shares are considered investments.

Taxation Upon Sale of IPO Shares

The crux of tax arises when these allotted IPO shares are sold. The tax implications are tied to the gains made from these transactions, known as capital gains.

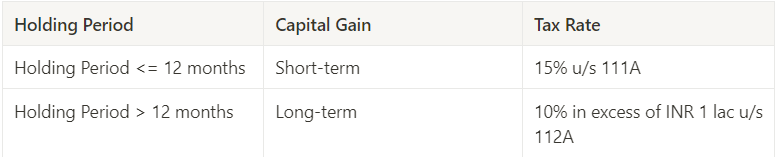

- Short-term Capital Gains: If shares are sold within 12 months of IPO allotment, resulting profits are categorized as short-term capital gains, subject to tax as per the applicable rate.

- Long-term Capital Gains: Selling IPO shares after holding them for more than 12 months results in long-term capital gains, which are also taxable.

Tax Payment Schedule and Advance Taxes

Tax payments on these gains are based on the holding period and the corresponding categorization of capital gains. It’s advisable to pay taxes on such income as and when it is earned to avoid last-minute tax burdens.

For instance, if one sells IPO shares on the day of listing, resulting in short-term capital gains, tax payment should align with the applicable quarter. Advance tax payments are required if the tax liability for the year exceeds ₹10,000. Failing to pay advance taxes in time may lead to penalties.

Advance Tax Payment Reminder

Considering the example of receiving IPO shares in November and selling them immediately, resulting in short-term gains in the third quarter, advance tax should be paid before the Q3 deadline to avoid penalties. Timely payment is crucial to prevent unexpected financial liabilities.

Conclusion

In summary, while IPO allotment doesn’t incur immediate taxes, gains from selling these shares are taxable under capital gains. Understanding the tax implications based on holding periods and paying taxes on time is essential to avoid penalties and ensure financial compliance.