We all know by now that IPO is a good way to make money in the short term.

In the short term, Listing gain is the main Profit generator in IPOs.

But getting an allotment in IPO is very tough in a high demand IPO.

Today I’m going to give you some tips to increase your chance of getting an allotment.

There is no guarantee in this world for anything, even our life but still, we can try to improve our chances of allotment.

Page Contents

How to Increase Your IPO Allotment Chances

Here are some of the things to keep in mind while applying for an IPO.

1. Apply through ASBA

ASBA is the best way to for an IPO.

You can apply through UPI but sometimes due to high demand, your application may get errors and get rejected.

Another benefit of applying through ASBA is that you will get an email from NSE/BSE at the end of the day so you can be sure that your application is submitted successfully.

2. Apply for Cutoff Price

Apply for the cutoff(highest) price of the IPO price band.

When IPO gets oversubscribed then the highest price will be used as the cutoff price.

3. Apply for The Minimum Bid Lot

Only apply for 1 lot.

As per rules if an IPO gets oversubscribed then retail investors can only get a maximum of 1 lot.

So there is no advantage to applying for more than one lot from 1 account. You can still apply from your family members accounts

4. Use Family’s Demat Accounts

You can apply from your family’s demat accounts to get a higher chance of allotment.

Only apply for one application per person. You can open a free Demat account on Groww for your family as Groww does not charge any AMC(annual maintenance charge).

Do not use your own accounts to apply for IPOs. Keep in mind, you should only apply from one Demat account per pan number.

5. Verify All the Details

While applying for an IPO, enter your details carefully.

Double-check your entered information.

- Enter your name as per pan card/bank account.

- Check your Demat account number.

- Check the category you are applying in like individual, employee, shareholder, HNI, etc.

Your application may get rejected because of wrong information.

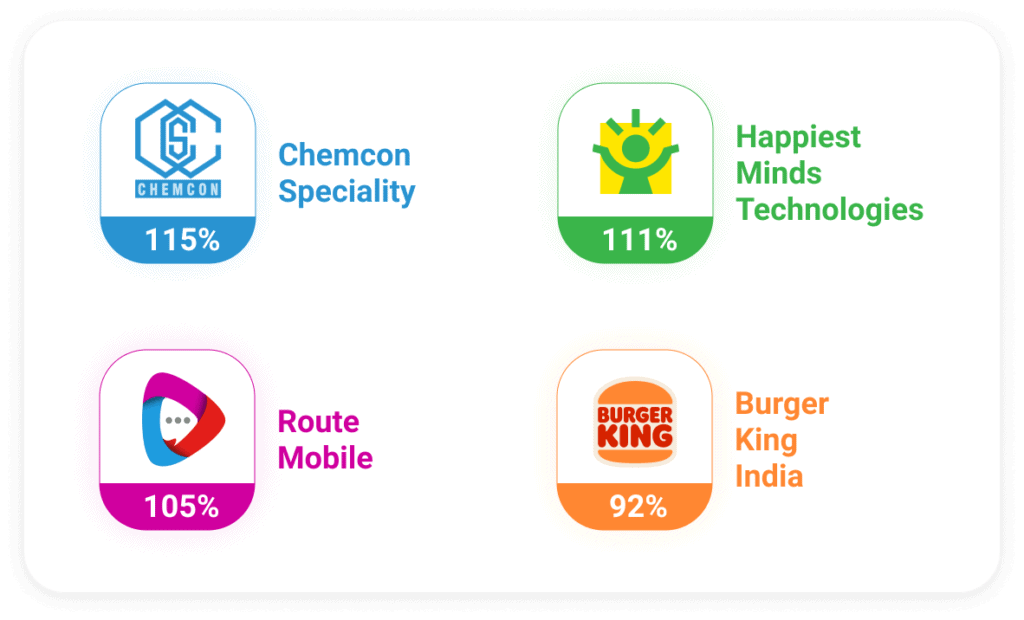

6. Buy a Share of the Parent Company

If the company launching the IPO is a subsidiary of any listed company then there is a high chance that there will be a shareholder quota to apply for the IPO of that company.

Buy 1 share of the parent company and apply for IPO in shareholder quota.

Shareholder quota will have fewer applications compared to retail investor quota.

Conclusion

IPO allotment is a lottery system so you can not do something to trick the system but you can use these tips to improve your chance of getting an allotment.

Don’t lose hope if you didn’t get an allotment in the IPO, you can always buy the share of that company after the listing if that stock’s valuation & fundamentals are good.

Let me know in the comments below if you have any suggestions or question.