If you had invested ₹10,000 in the Nifty Index Fund in 1995 your investment would have been grown 10x to ₹ 1,00,000.

Yes, that’s right, you could have made 10x your investment just by doing nothing, no stock research, no balance sheet checking nothing.

So now you must be wondering that what is an Index Fund and how can you invest in it right?

That’s what we are going to learn.

“By Periodically Investing in an Index Fund, the Know-Nothing Investor Can Actually Out-Perform Most Investment Professionals,”

Warren Buffett

So Buckle up and Let’s Get into It.

Page Contents

What Is Index Funds?

As the name suggests index funds are the mutual funds that invest in an index. Whatever you invest in index funds is directly invested in companies that are selected on that particular index.

If you invest in the Nifty index fund then you will get almost the same return as the Nifty.

Index funds are passive funds so expense ratio will be low.

To learn more about what is Index fund we need to know what is an index.

What Is Index?

An index is something that derives their value from selected companies.

For example, Nifty50 (commonly known as Nifty) gets its value from India’s top 50 companies.

It helps us to easily track the movement of the stock market.

Types of Indexes

- Nifty50

- Nifty100

- Nifty Next50

- Sensex

- Bank Nifty

- Nifty Alpha 50 And Many More.

Why Should We Invest in Index Funds?

- Investing in index funds helps us to get exposer to top companies.

- It also helps in the diversification of our portfolio.

- Liquidity is also high in these funds. You can withdraw your investment anytime from index funds.

- Fees are also low compared to other mutual funds.

- If you are a beginner in the stock market and don’t know much about it then you should start by investing in index funds. It will lower your risk and gets a steady return.

- No need to worry about stock research and company financials. Just invest and forget about it.

If you invest ₹10,000 every month for the next 30 years, you can get a return of more than ₹2 crores!*

Difference between Index Funds and Index ETFs

There are two main differences between index funds and index ETFs.

- The expense ratio (read as charges) on index ETFs are lower than index mutual funds.

- You need a Demat account to invest in index RTFs whereas you do not need any demat account to invest in index mutual funds.

There are so many index funds available in the market.

Here are some mutual funds you can checkout.

| Index Fund Name | Expense Ratio | SIP (Minimum) | Lumpsum One Time Investment (Minimum) |

| UTI Nifty Index Fund – Direct Plan | 0.10% | ₹ 500 | ₹ 5000 |

| ICICI Prudential Sensex Index Fund – Direct Plan | 0.10% | ₹ 100 | ₹ 5000 |

| HDFC Index Sensex Direct Plan | 0.10% | ₹ 500 | ₹ 5000 |

| HDFC Index Fund Nifty 50 Plan Direct | 0.10% | ₹ 500 | ₹ 5000 |

How to Invest in Index Funds

Investing in an index fund is the same as investing in a mutual fund. You can use any platform that allows you to invest in mutual funds.

You Just Need PAN Card to Start Investing in Index Fund.

I’m going to show you how to invest in index funds via 3 platforms.

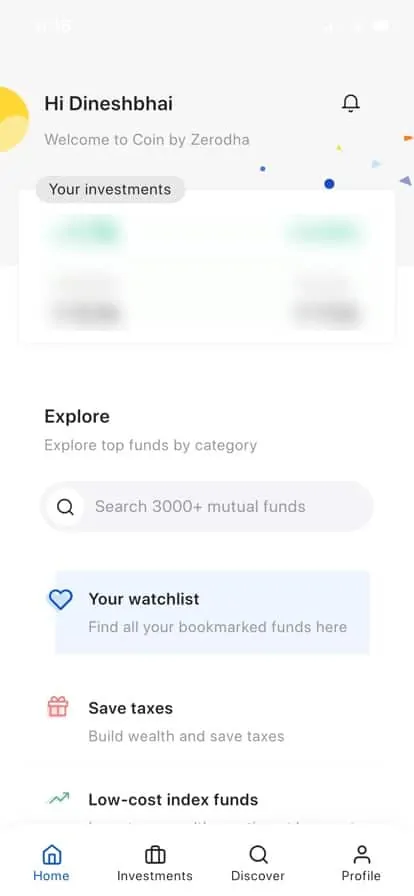

How to Invest in Index Fund via Zerodha Coin App

- Open Zerodha Coin App.

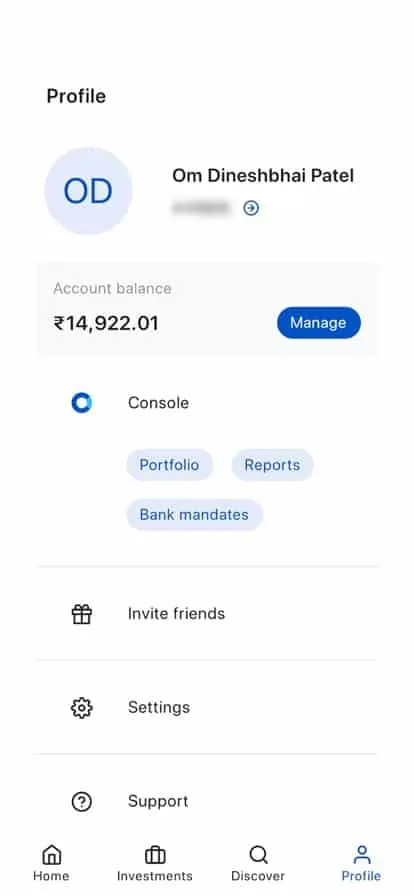

- If you don’t have funds to your Zerodha account then go to the profile tab and add funds by taping on the manage button. Complete payment via UPI/IMPS/Netbanking.

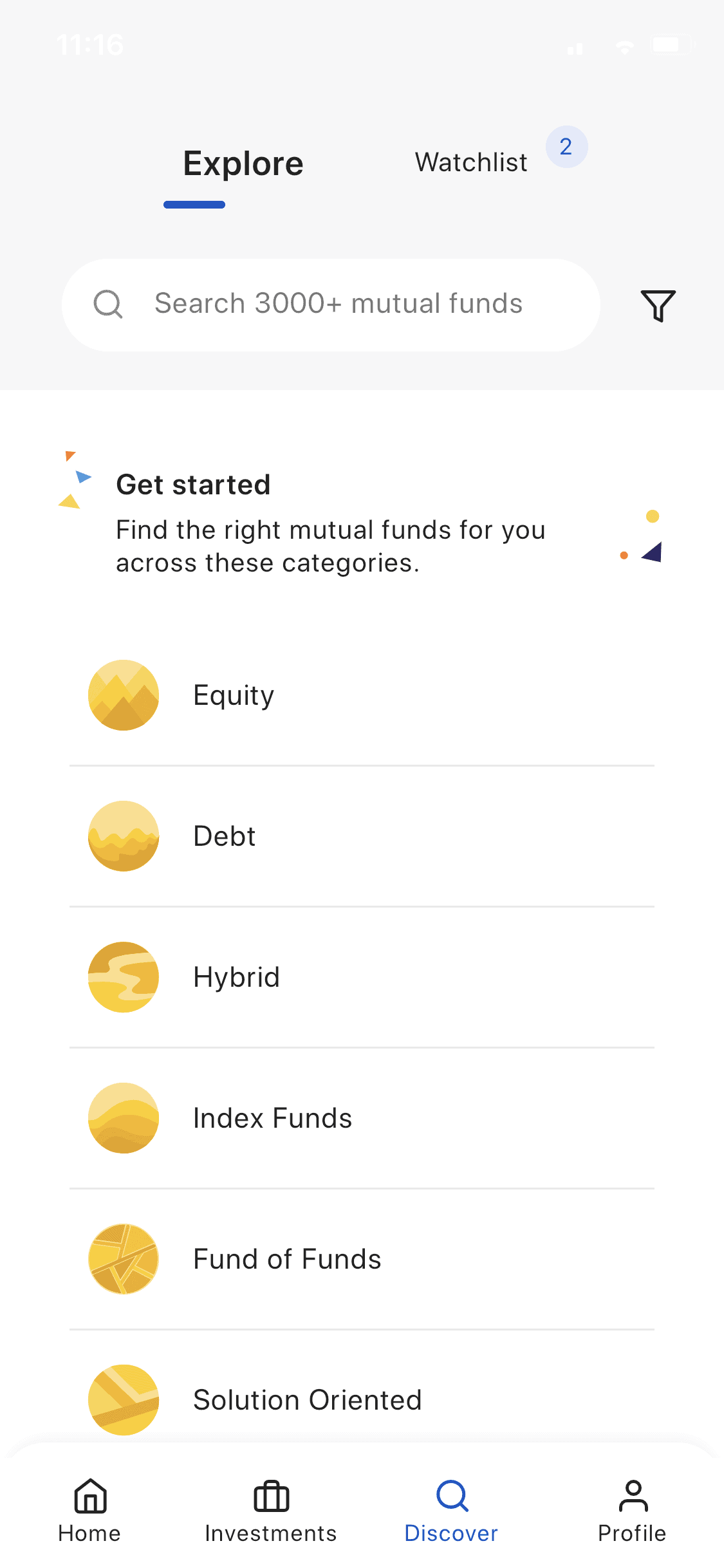

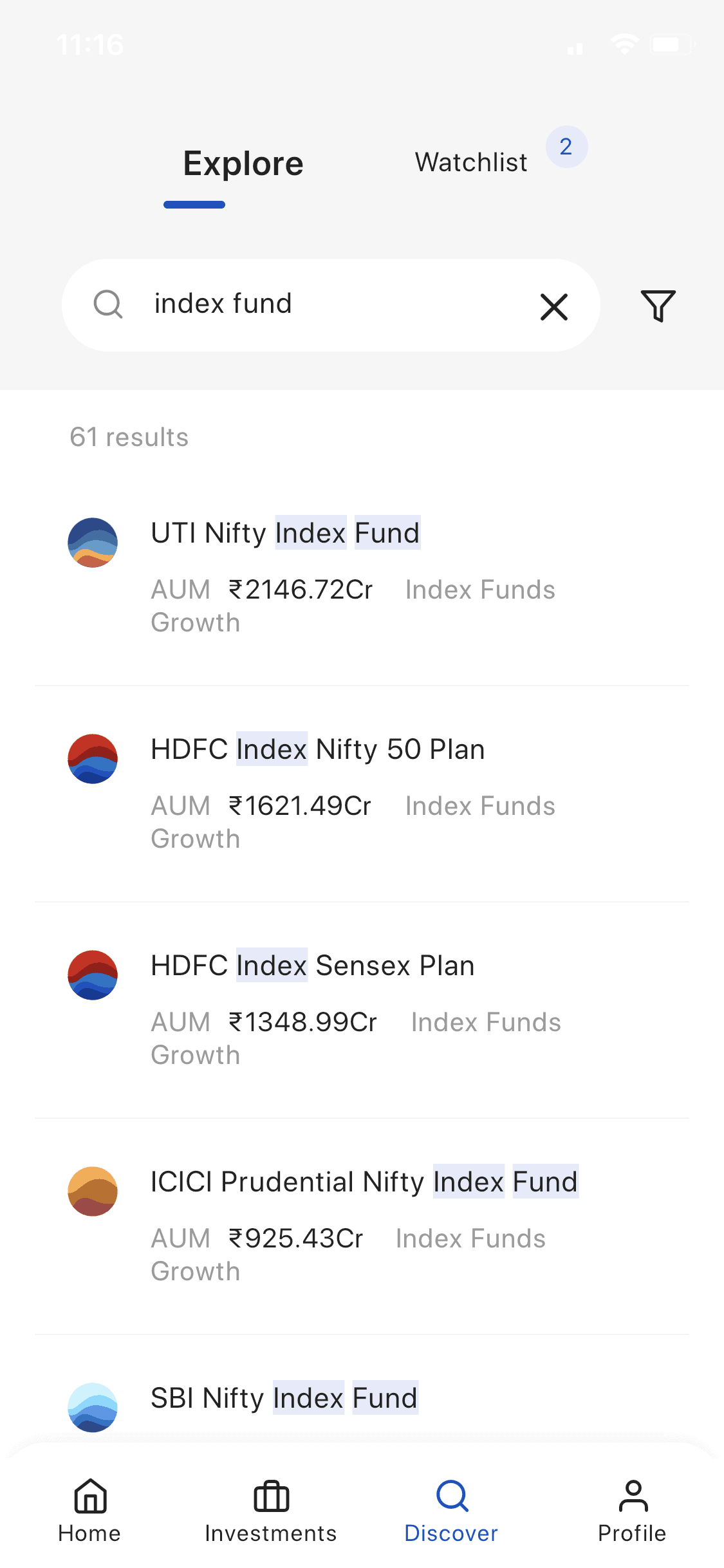

- Go to Discover Tab.

- Write index fund in the search field or select index funds from the list of suggestions.

.

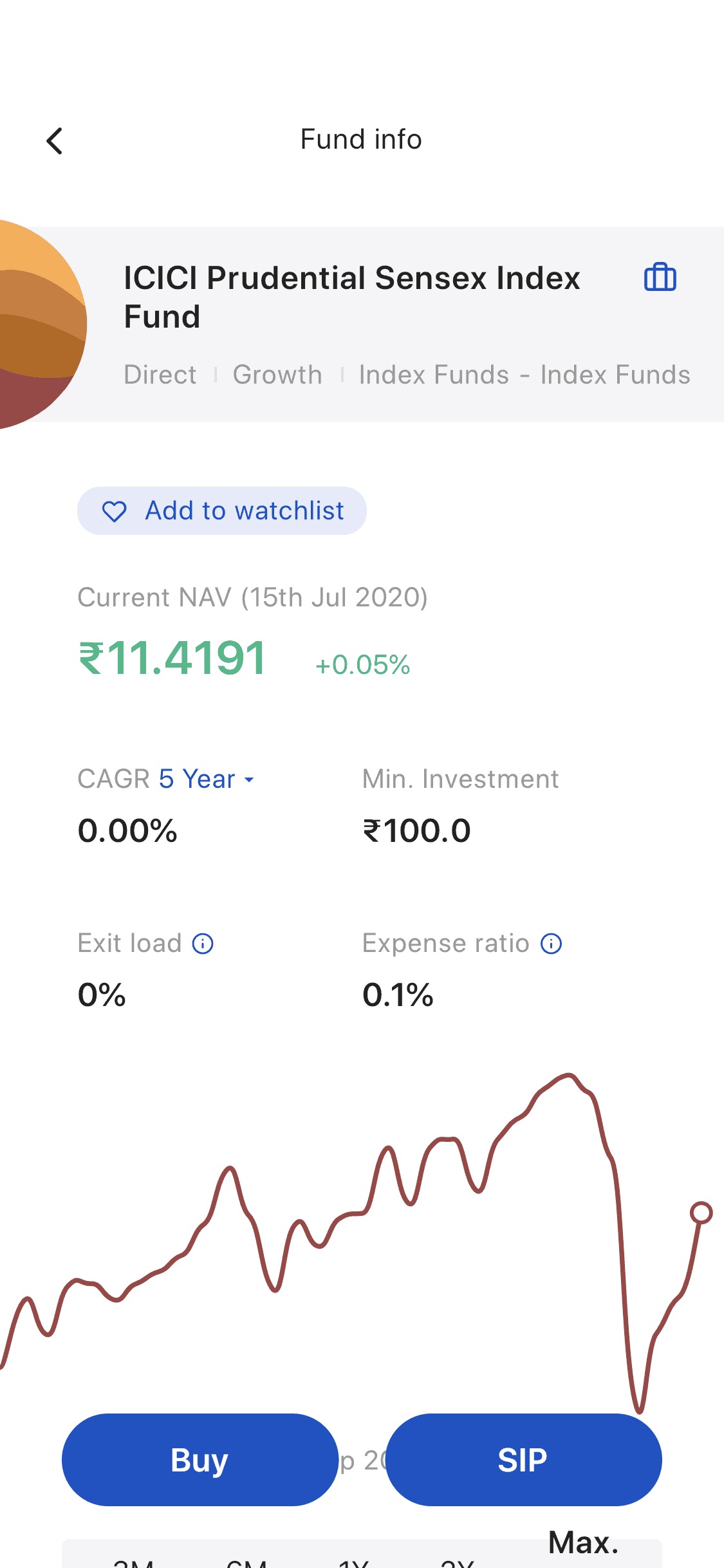

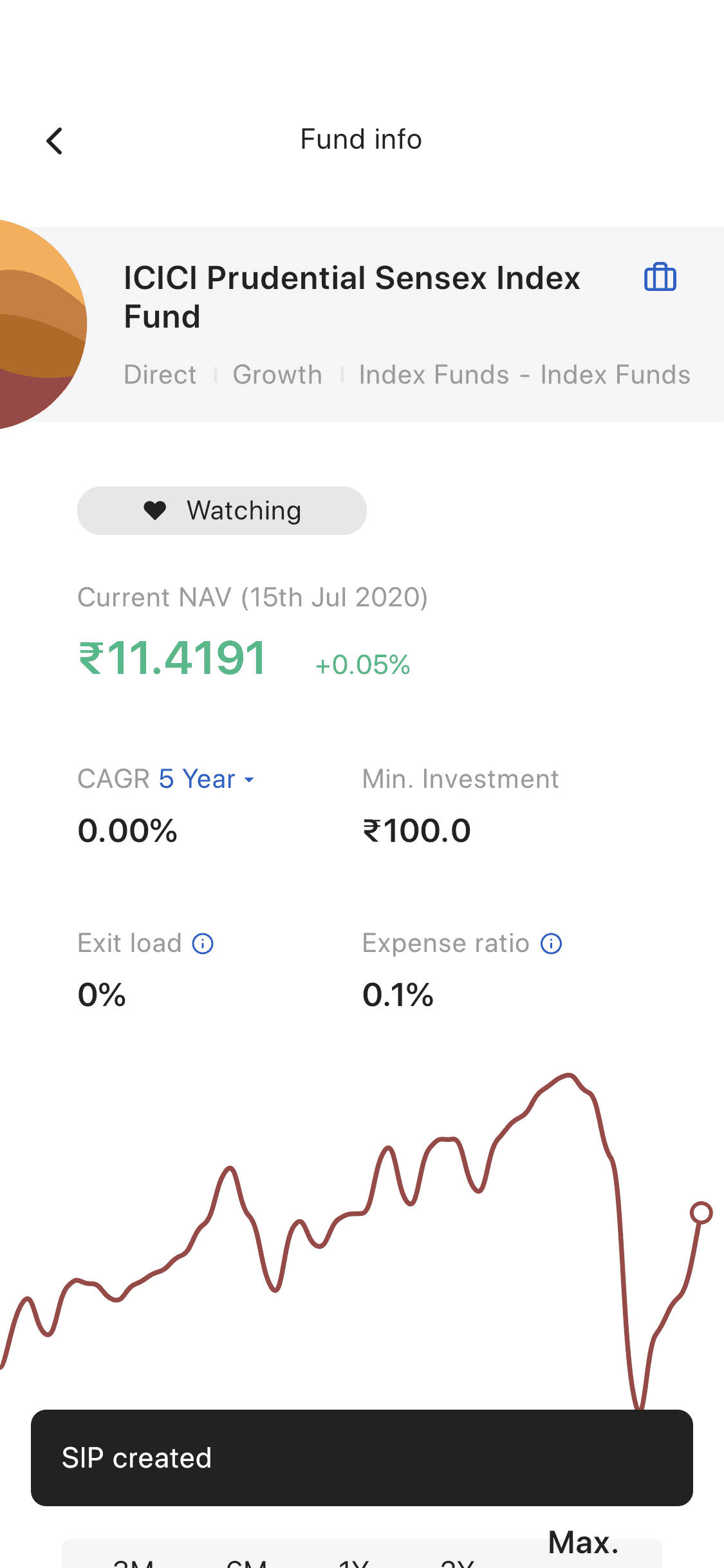

- Select the fund you want to invest in. In my case, I’m going to invest in the ICICI Prudential Sensex index fund.

- If you want to invest only one time then tap on the buy button. If you want to start SIP(Systematic Investment Plan) then go to step 11 below.

-

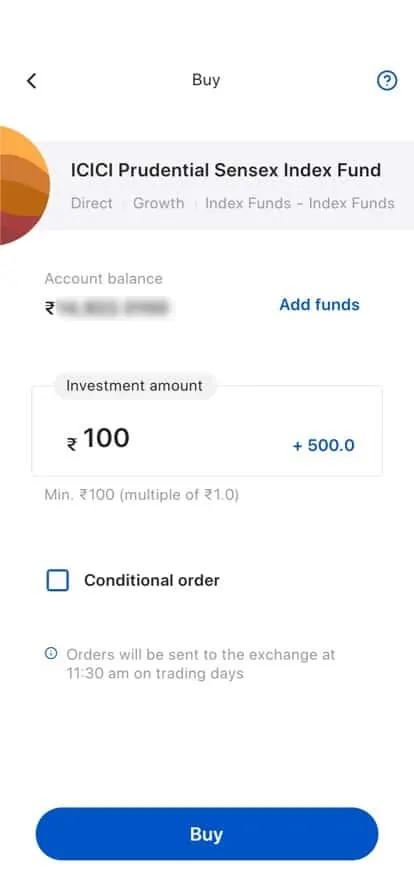

- You will get a screen like this to choose the amount you want to invest. Enter the amount and then tap on buy.

-

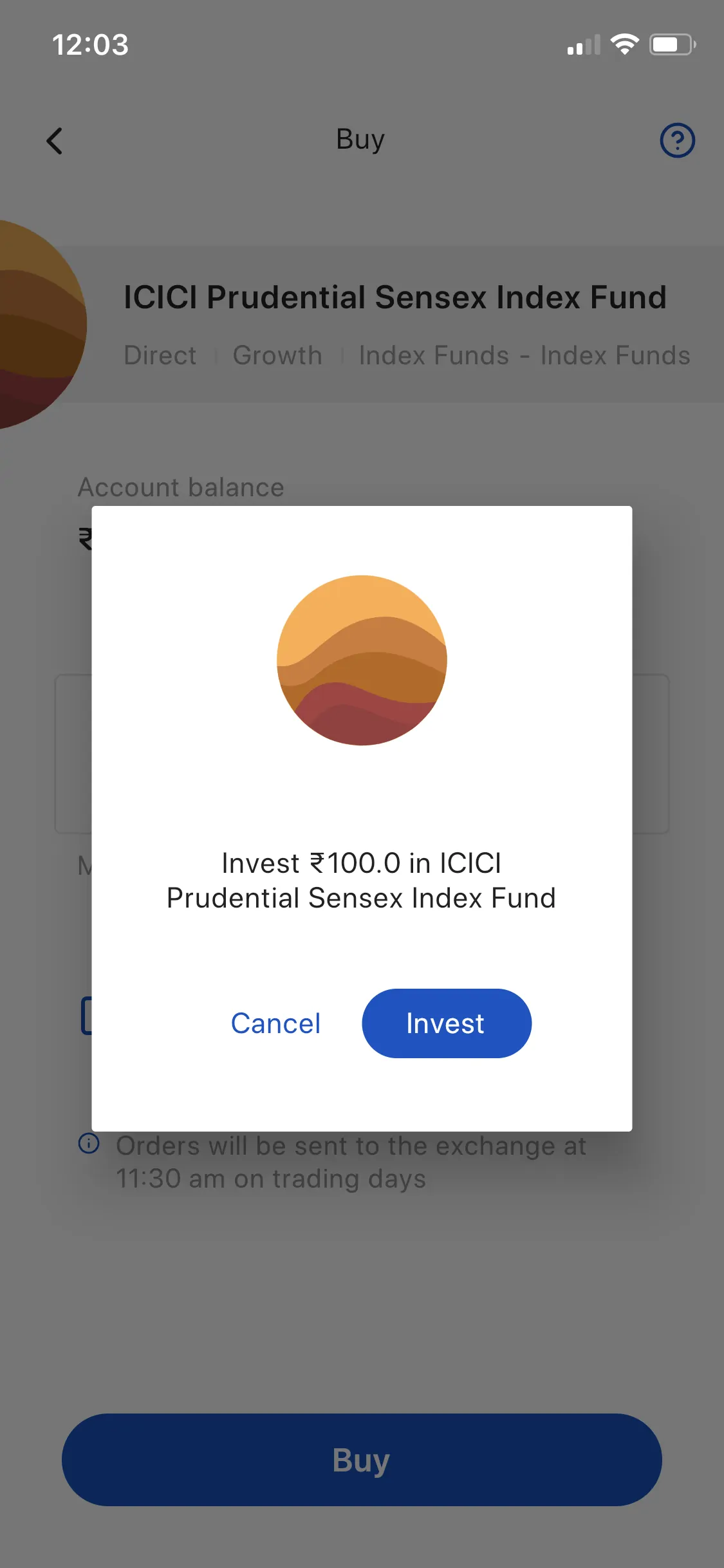

- On the next screen, it will ask you to confirm your investment order. Tap on invest.

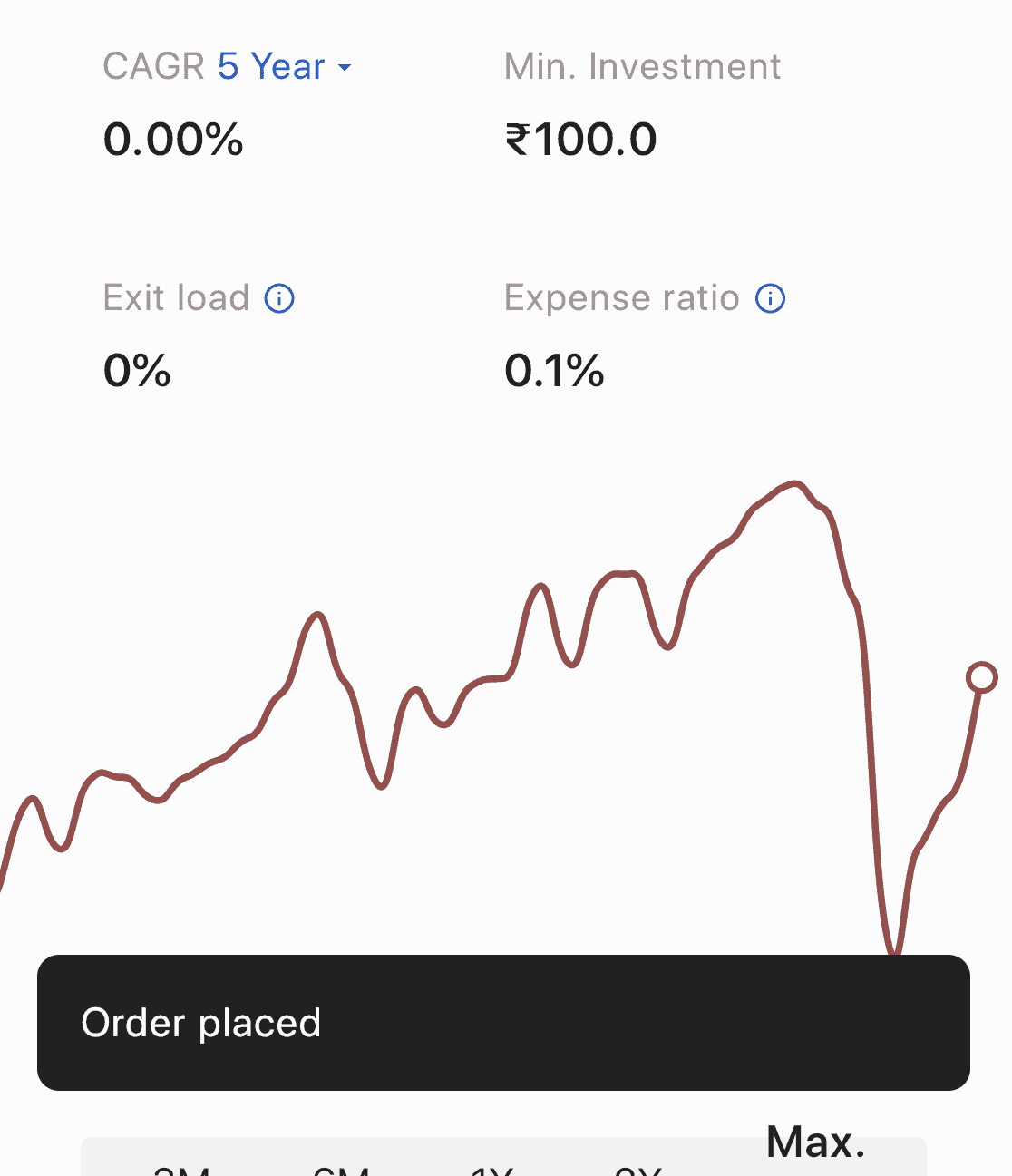

- Voila. You will get a message indicating that your order is placed.

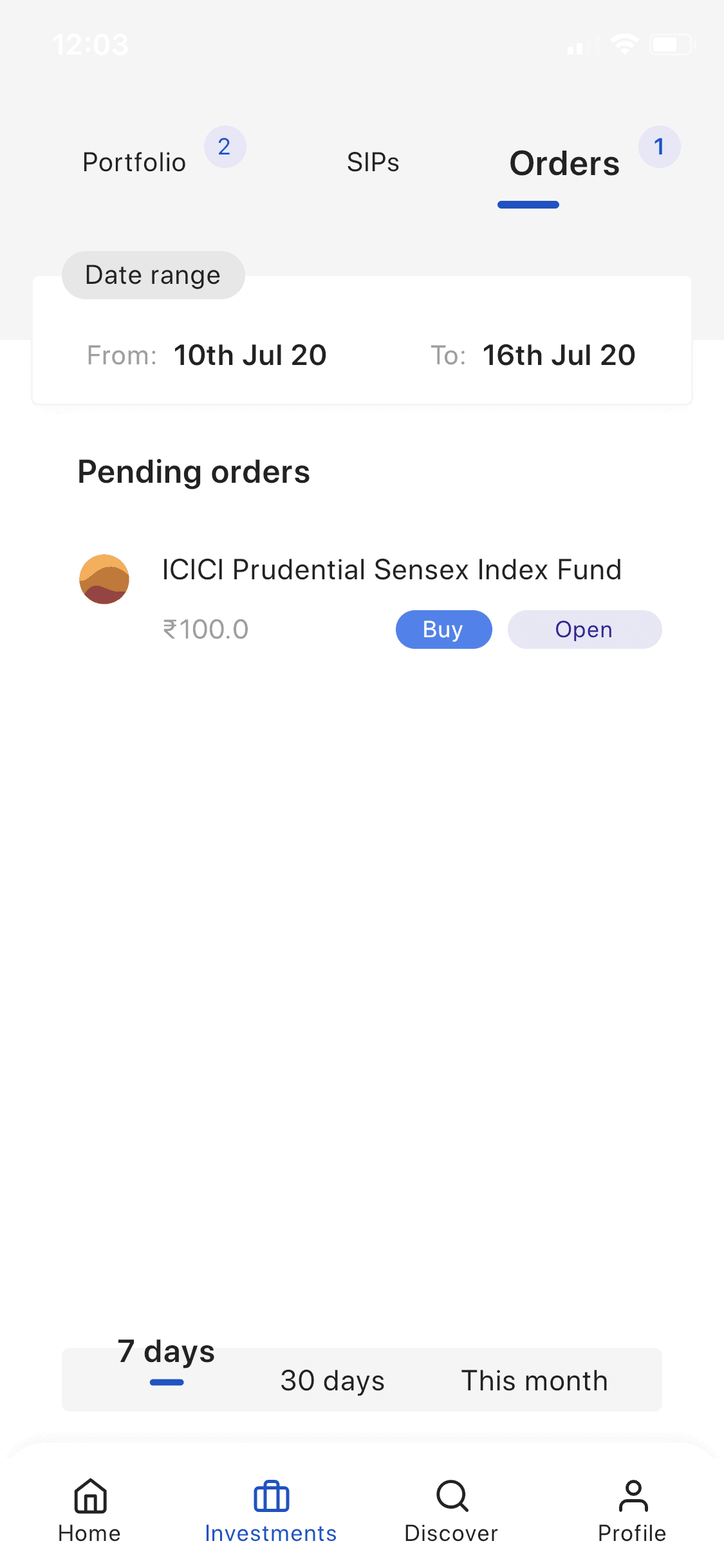

- You can check your order status on the investment tab.

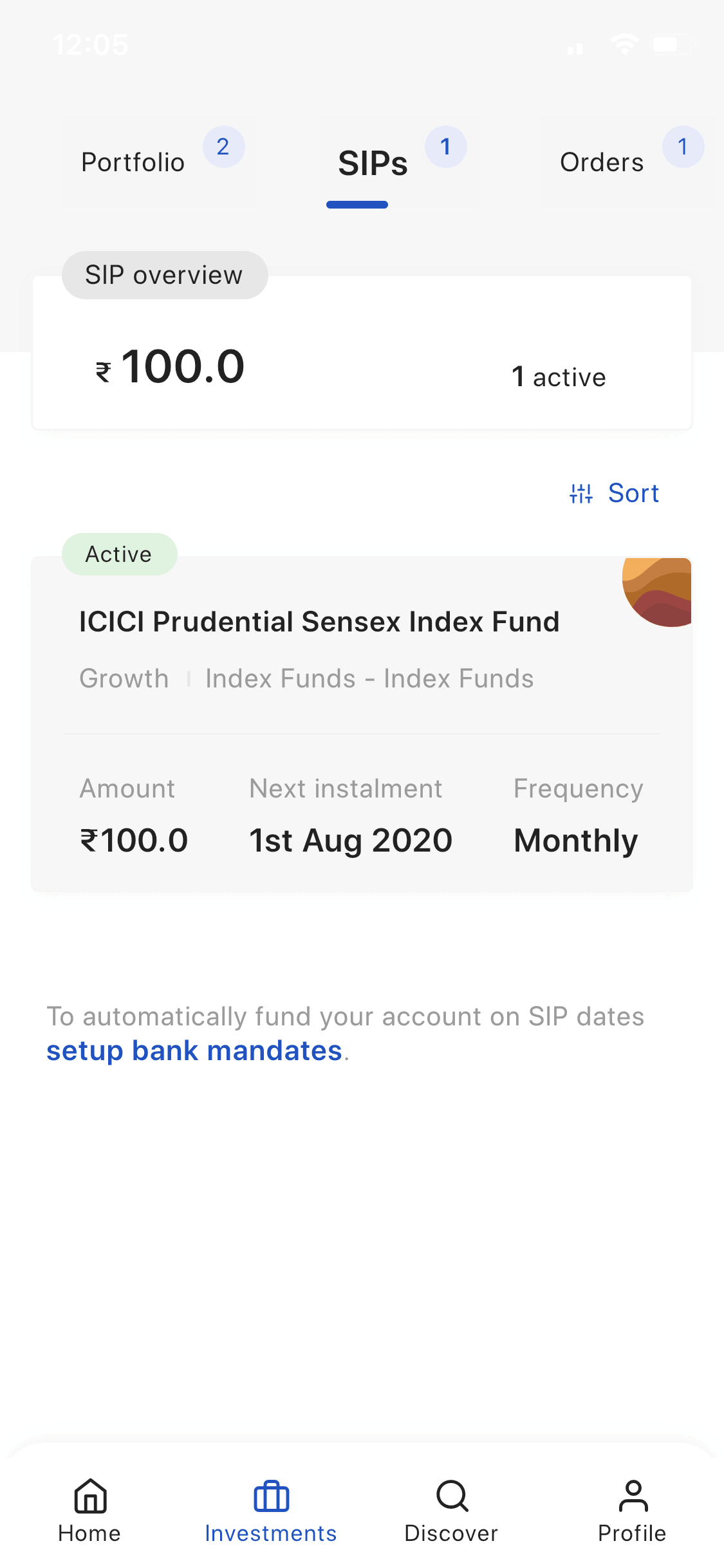

- If you want to start SIP(invest every month automatically) then tap on the SIP button.

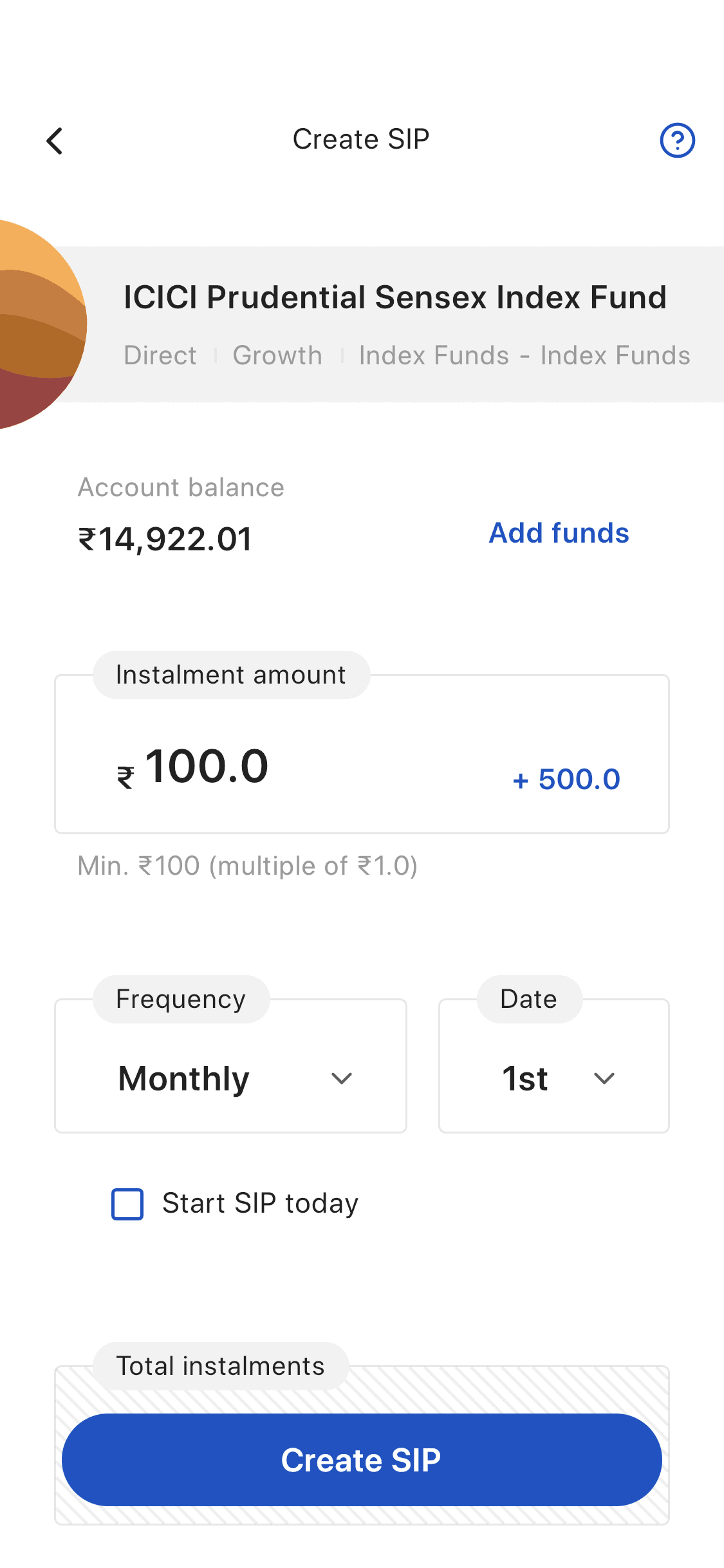

- On the next screen enter the amount you want to invest per month. Also, choose the date and frequency(weekly, monthly, quarterly). Then tap on create sip button.

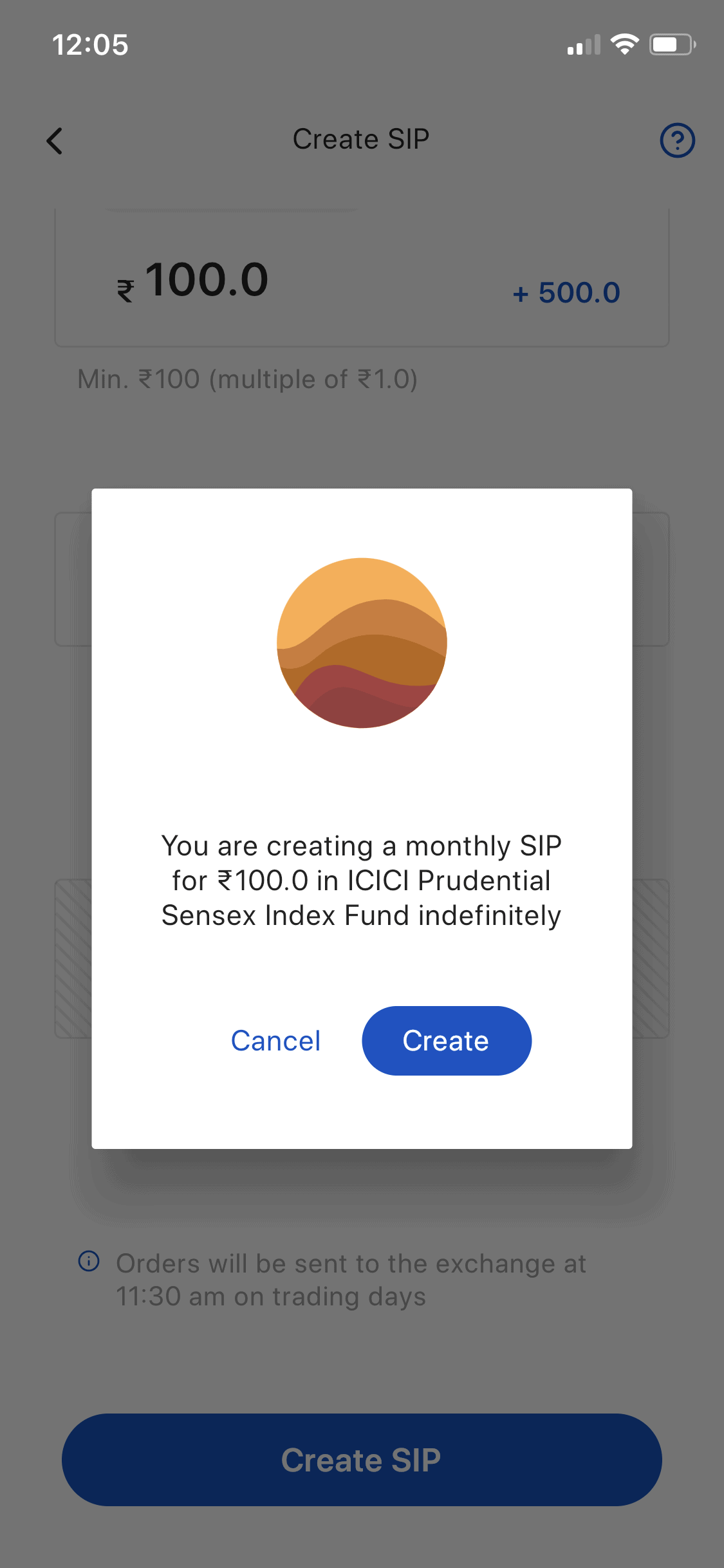

- Then will get a confirmation popup. Tap on create.

- And done… Your SIP is created.

- To check your SIP status got to the investment tab and tap on sips.

How to Invest in Index Fund via Groww App

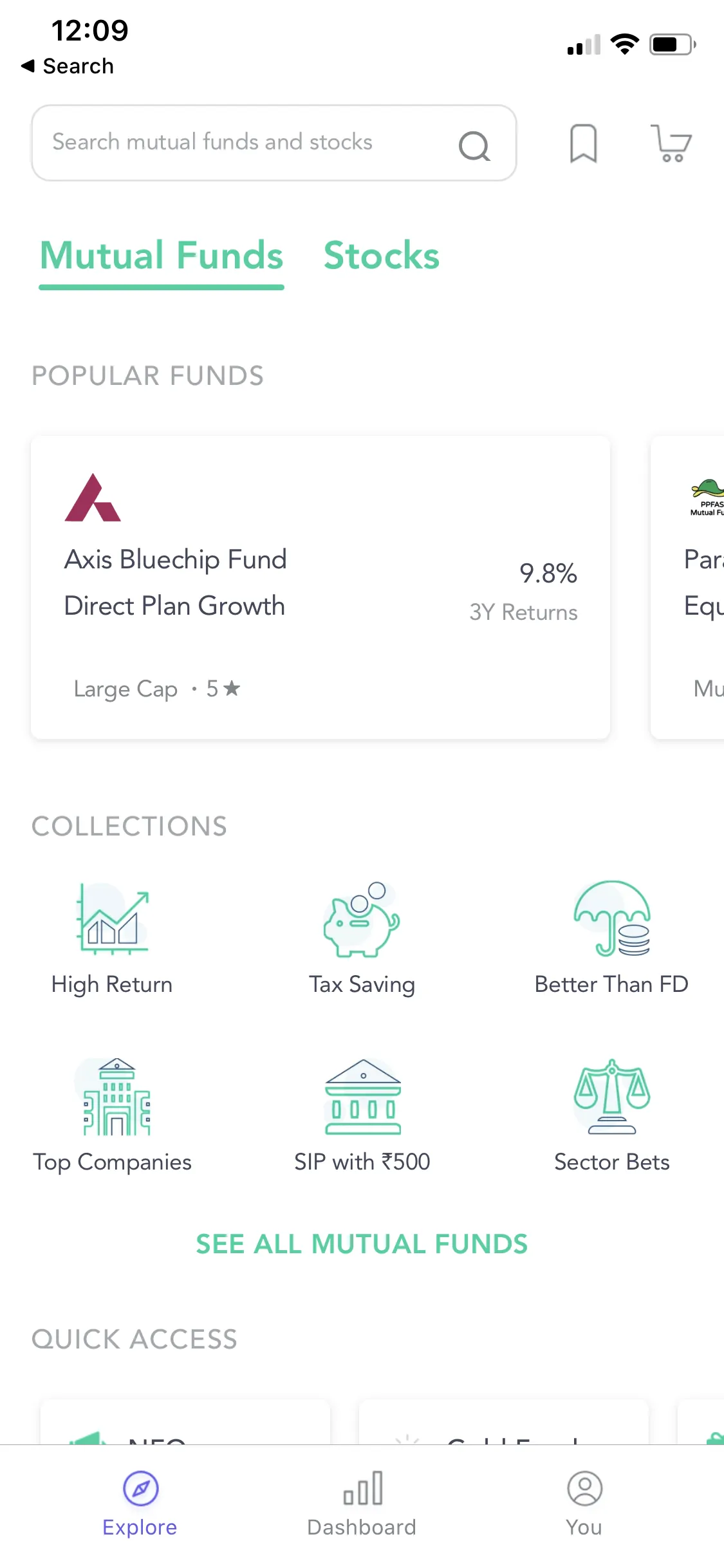

- Open Groww App.

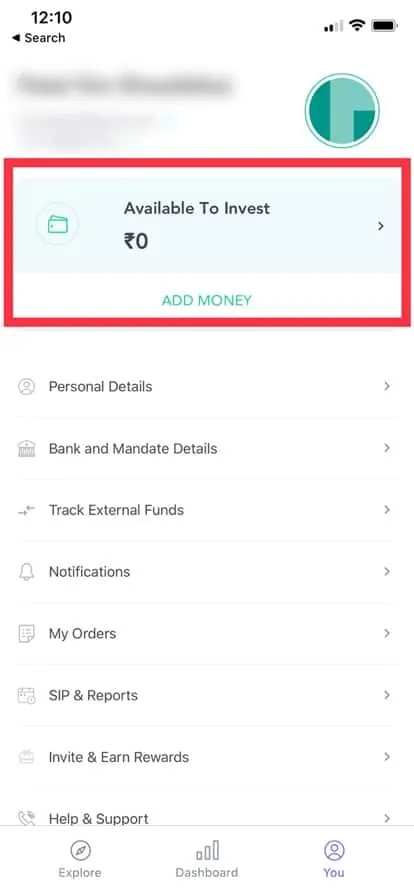

- If you don’t have funds in Groww then do it by going to you tab and taping the add money button.

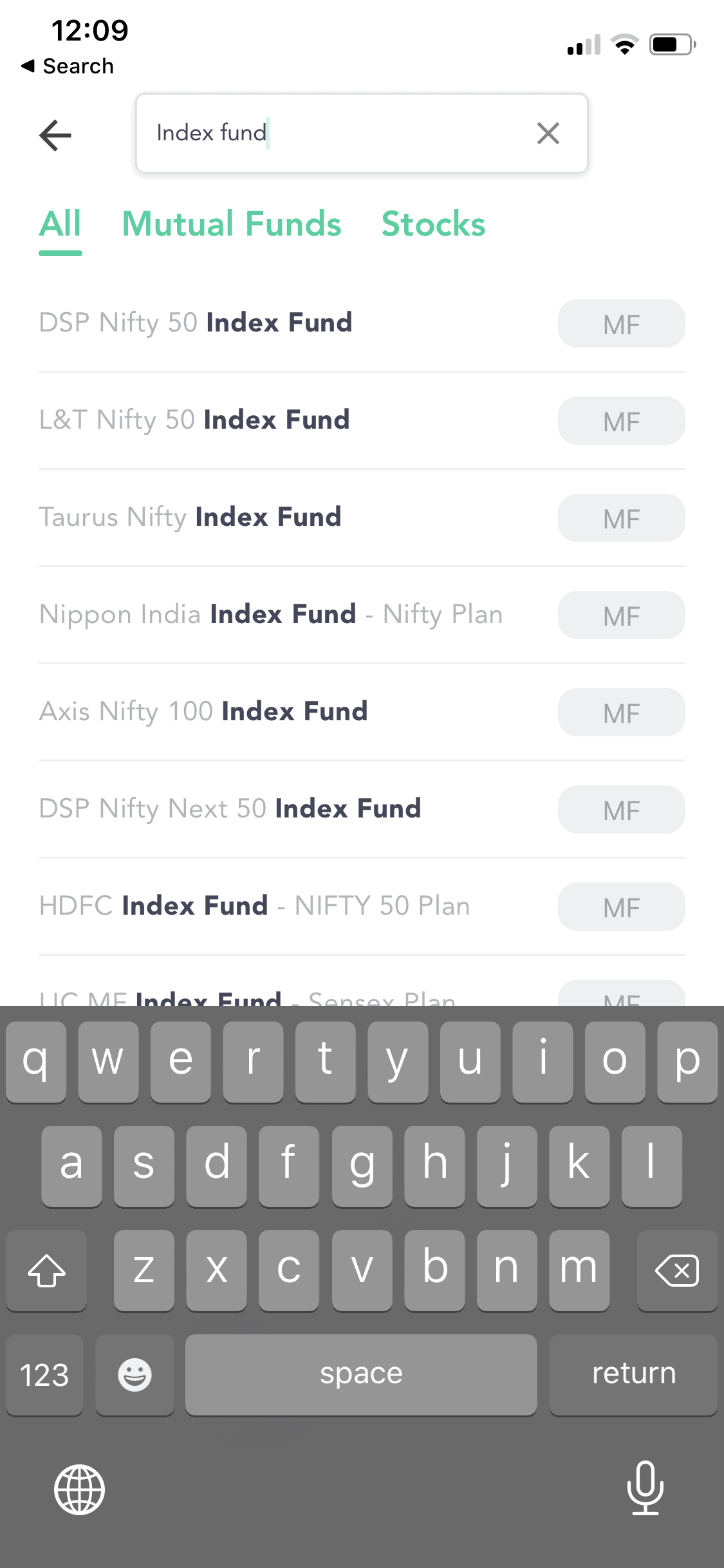

- Then tap on explore tab. Tap on the searchbox at the top and search for the index fund.

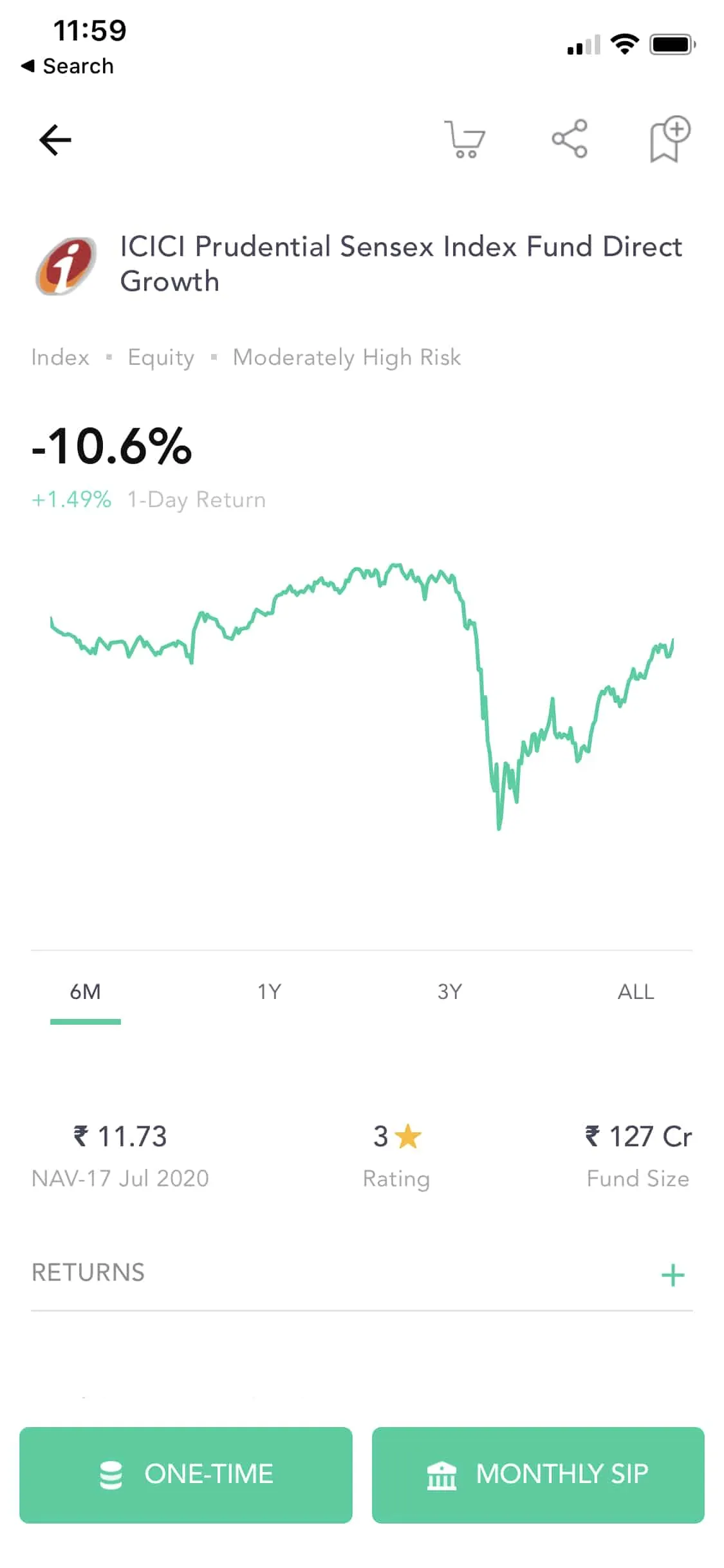

- Choose the one you want to invest in. I’m going to invest in the ICICI Prudential Sensex index fund. Tap on the one-time button.

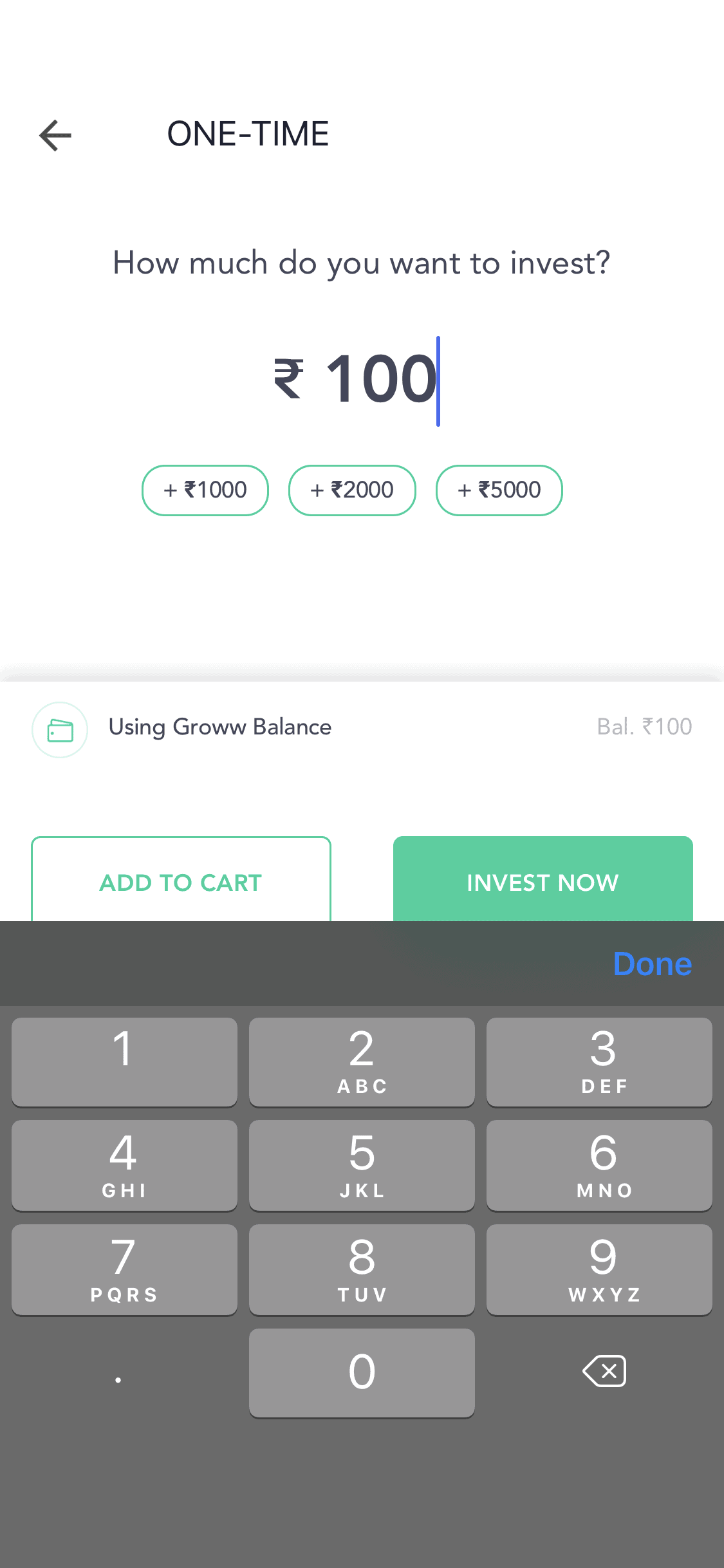

- Enter the amount you want to invest in this fund. Then tap on invest now.

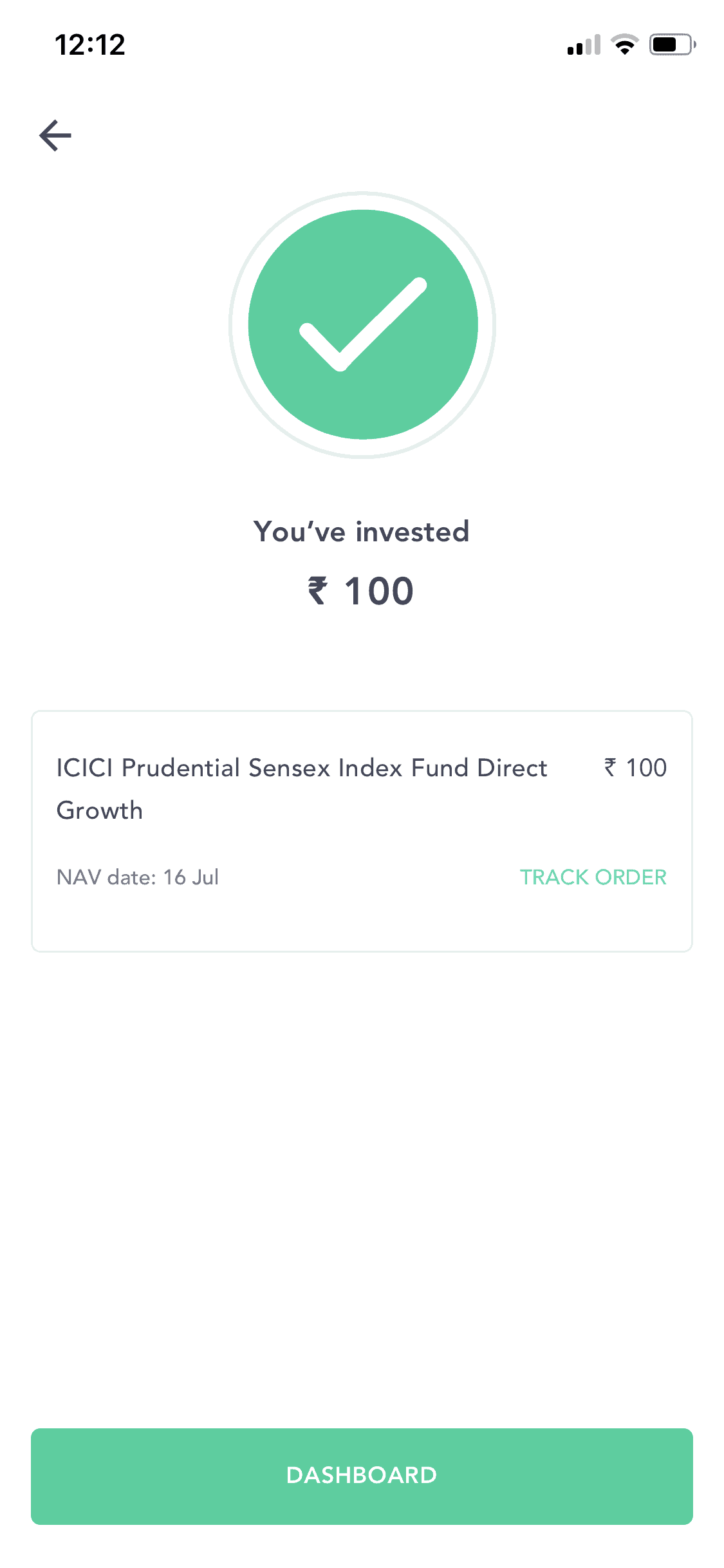

- And that’s it. Your investment is completed.

How to Invest in Index Fund via Paytm Money App

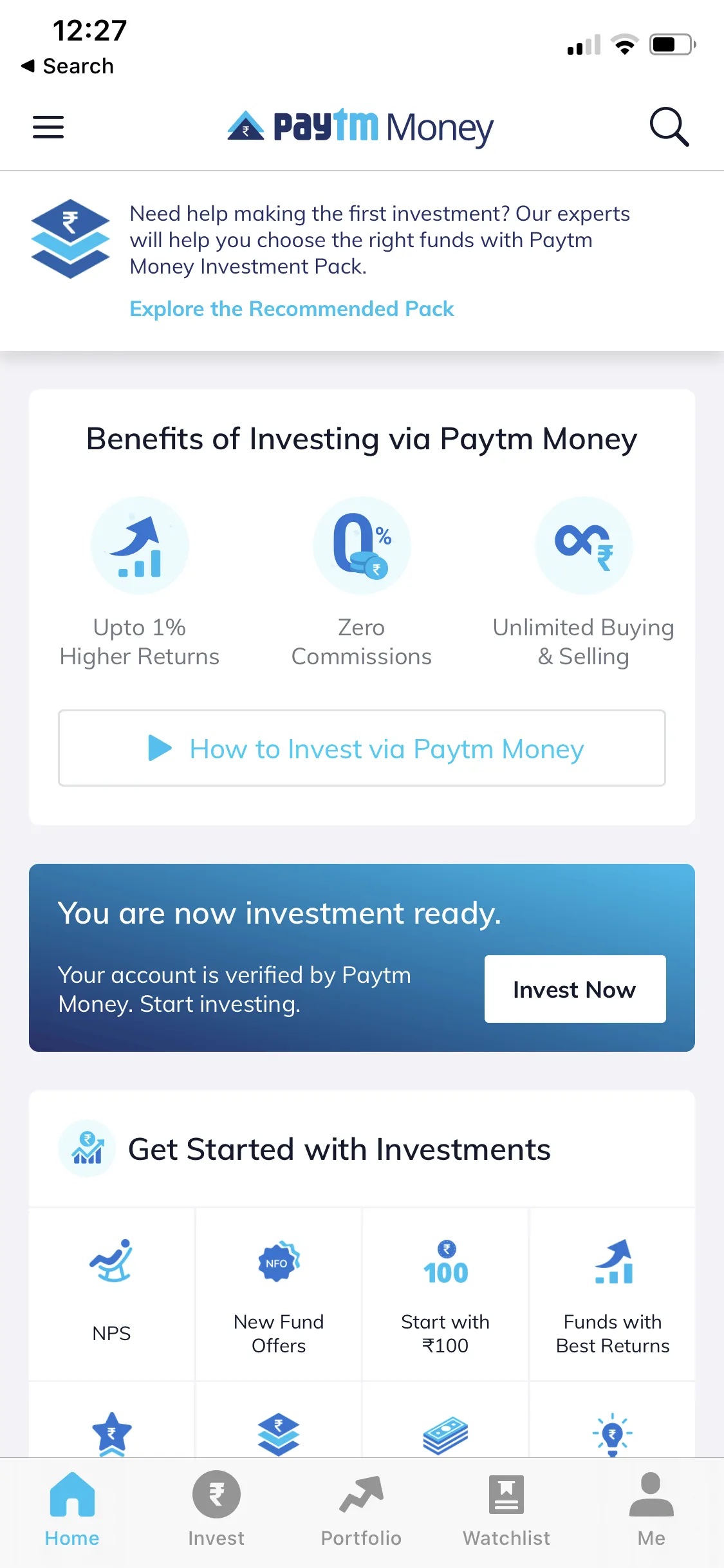

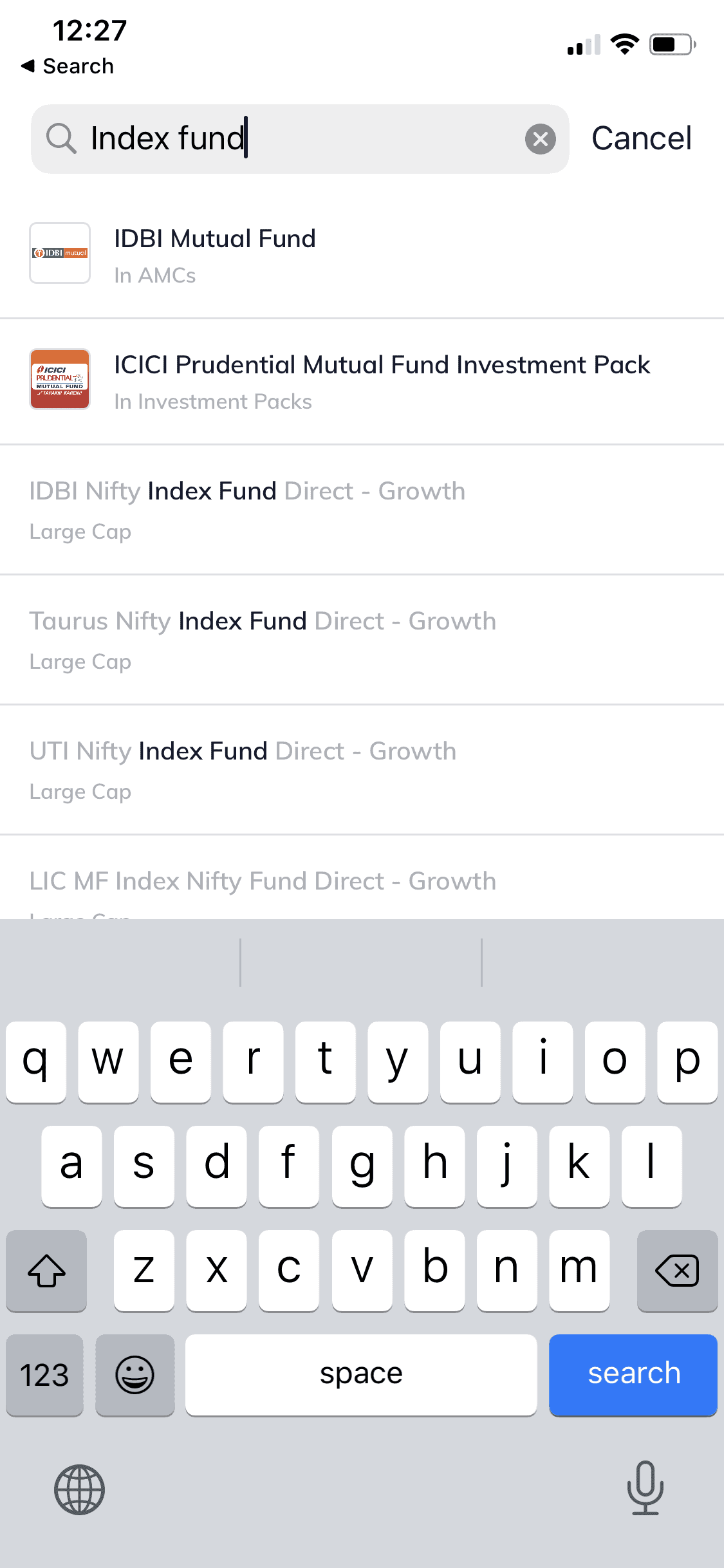

- Open Paytm money app. Tap on the search icon on the top right corner.

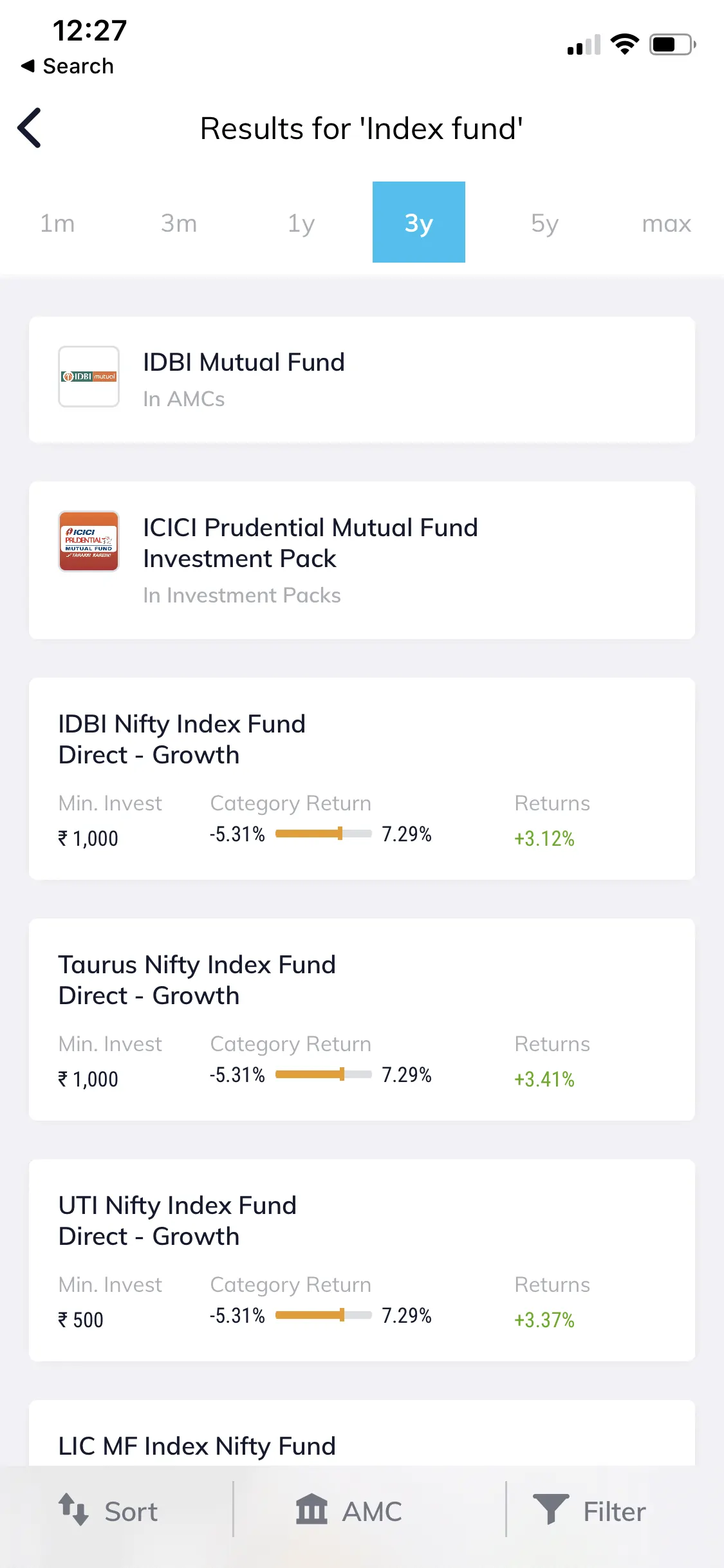

- Search for Index Fund.

- Tap on the fund you would like to invest in.

- You will get a screen with details regarding your fund. Tap on invest now.

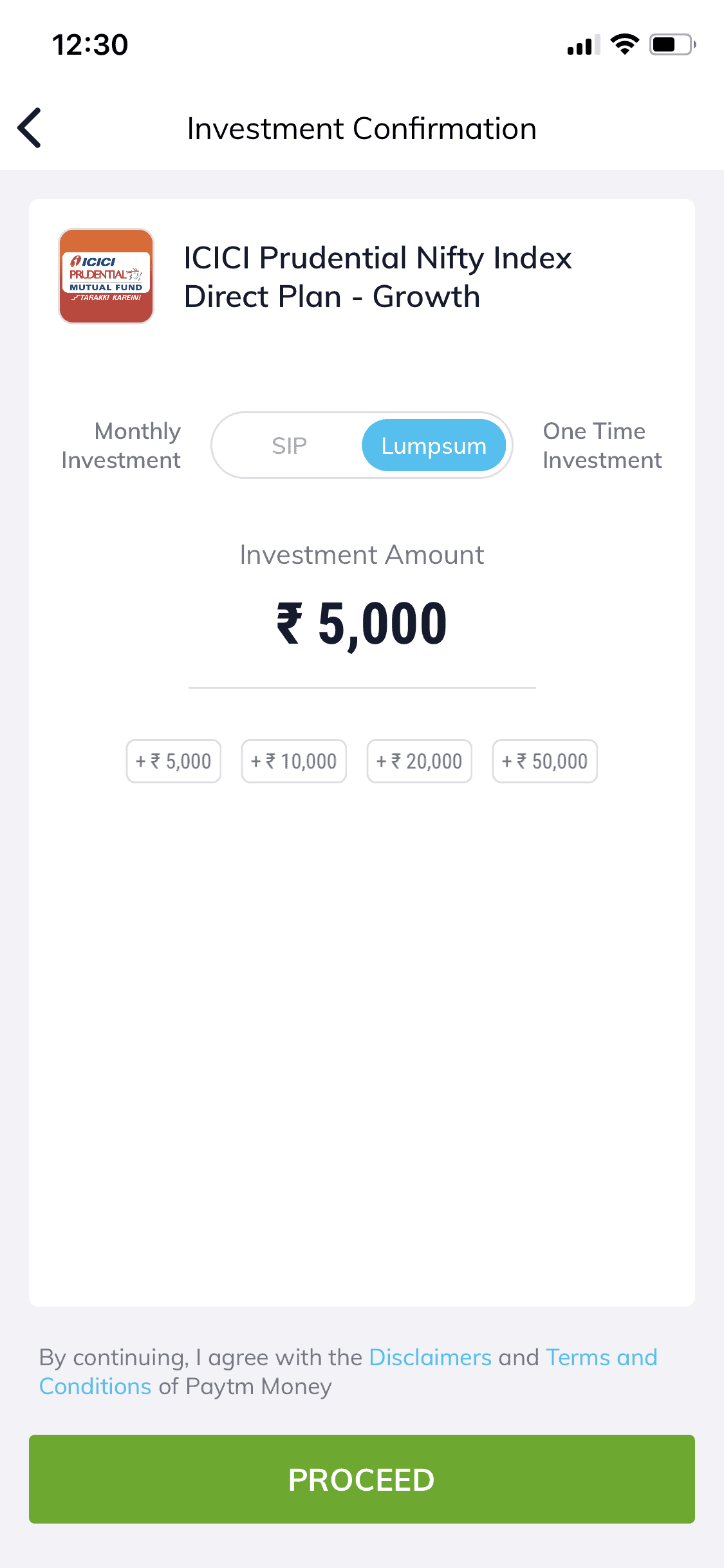

- Choose one option from SIP or Lumpsum. Enter the amount you want to invest. Tap on proceed.

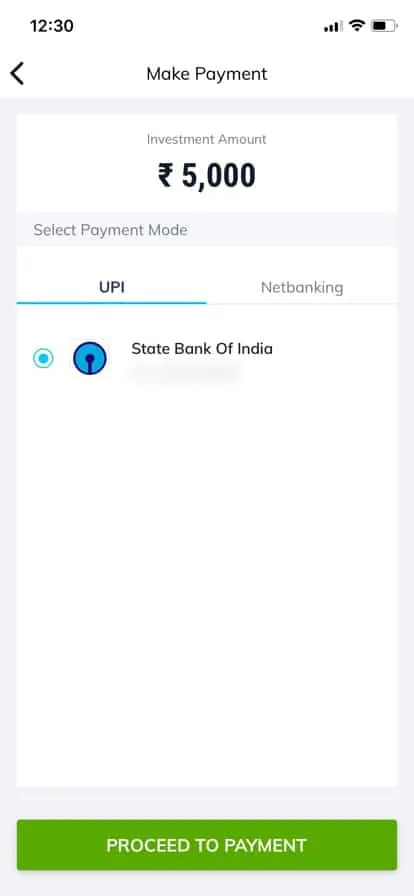

- Choose your payment method. Tap on proceed to payment.

- That’s it. Your investment is completed.

Read: Stock Market Holidays

Conclusion

If you a working professional and want to invest in the stock market to grow your wealth and be part of the country’s development then an index fund is the best options for you.

The index fund is one of the safest options in the stock market. It is made up of top companies so the risk is very low.

Let me know in the comment section below if you need any help or have any questions. I am happy to help.

.

.