Everyone loves to save income tax on their salary, especially we Indians.

This article is specifically drafted for salaried people to save income tax on their salary.

I will cover most of the ways to save income tax under the income tax act

So let’s get started.

Page Contents

Standard Deduction

Maximum Deduction: Rs. 50,000 (AY 2020-21)

For the Assessment Year 2020-21, you can avail of a standard deduction of Rs. 50,000.

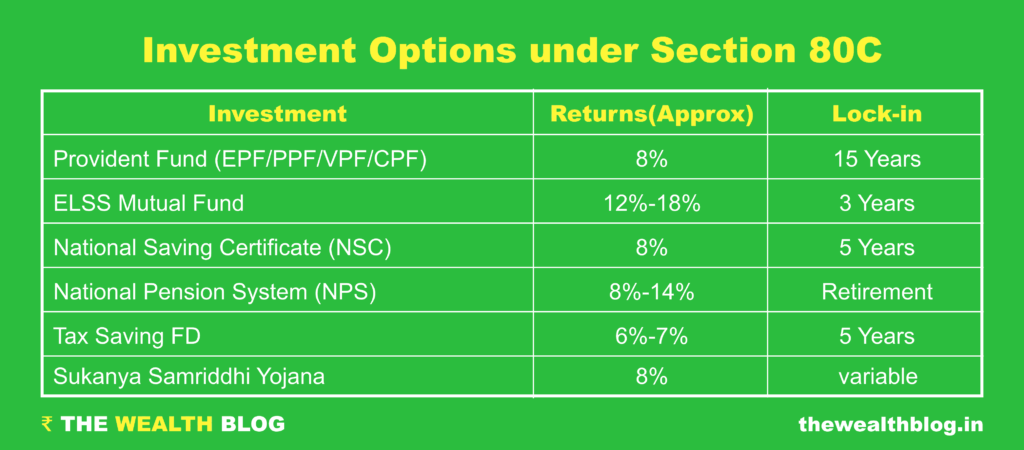

Under Section 80C

Maximum Deduction: Rs. 1,50,000 (AY 2020-21)

Note: You can avail maximum tax benefit of up to rs.1,50,000. It is combined of all investment listed below under this section 80C except the national pension system(NPS).

Provident Fund

Employee Provident Fund (EPF)

Employee Provident Fund account gets automatically opened when you join any organization (any company having more than 20 employees has to register with the EPFO).

Some organization also Calls it Central Provident Fund (CPF) or Voluntary Provident Fund (VPF).

The employer contribution to your EPF is tax-free, and your contribution is tax-deductible under Section 80C of the Income Tax Act.

The interest earned and the money you eventually withdraw after the mandatory specified period (5 years) are exempted from income tax.

EPF accounts yield a return of around 8% annually.

In EPF, the amount is paid at the time of retirement or resignation, whichever occurs earlier. You Can also Withdraw this amount in case of any medical emergency.

EPF is one of the best way to save income tax on your salary.

Return On Investment(ROI): Around 8%

Maximum Deduction: Rs. 1,50,000 (AY 2020-21)

Lock-in Period: Till Retirement or Unemployment

Public Provident Fund (PPF)

If Your Employer Doesn’t offer EPF then You Can Open a PPF Account At any bank and avail of the income tax deduction under Section 80C of the Income Tax Act.

The interest earned and the returns are not taxable under Income Tax.

In Case of any Emergency, You can get loan Against your PPF balance.

Return On Investment(ROI): Around 8%

Maximum Deduction: Rs. 1,50,000 (AY 2020-21)

Lock-in Period: 15 Years

ELSS Mutual Fund

Equity Linked Savings Scheme or ELSS is a type of mutual fund scheme where most of the fund corpus is invested in equities or equity-related products.

Investments made under ELSS eligible for a tax deduction of up to Rs. 1.5 lakh under Section 80C of the Income Tax Act.

The amount received at the end of maturity is not taxable.

Return On Investment(ROI): Around 12% – 18%

Maximum Deduction: Rs. 1,50,000 (AY 2020-21)

Lock-in Period: 3 Years

National Saving Certificate (NSC)

National Saving Certificate or NSC are bonds issued by the government for small savings and one can purchase these bonds from the Indian post office.

Minimum investment one can make is Rs 100 with a lock-in period of 3 years.

The current interest rate on NSC is 8%.

The interest rate on NSC is decided by the government every year. It is linked to the yield of 10-year government bonds.

NSC is also a tax-saving investment avenue wherein investments made are eligible for a tax deduction of up to Rs 1.5 lakh under Section 80C of the Income Tax Act. However, the interest earned is taxable.

Return On Investment(ROI): Around 8%

Maximum Deduction: Rs. 1,50,000 (AY 2020-21)

Lock-in Period: 3 Years

Tax Saving FD

Tax Saving FD is a special fixed deposit option offered by banks.

It comes with a lock-in period of 5 years (minimum) and 10 years (maximum).

The interest rate on tax-saving FDs varies from bank to bank and usually ranges from 6.5-7.5%.

Investors get a tax benefit of up to Rs 1.5 lakh under Section 80C of the Income Tax Act.

Return On Investment(ROI): Around 6% – 8%

Maximum Deduction: Rs. 1,50,000 (AY 2020-21)

Lock-in Period: 5 Years

Sukanya Samriddhi Yojana

Parents of a girl child below the age of 10 can get this deduction.

This account has a tenure of 21 years or until the girl marries after turning 18.

You can open an account at any branch of an authorised bank or at a post office.

It has an interest above prevailing rates (currently 8.5%) and the interest is tax-free.

Return On Investment(ROI): Around 8.5%

Maximum Deduction: Rs. 1,50,000 (AY 2020-21)

Lock-in Period: 21 years or until the girl marries after turning 18.

Senior Citizens Savings Scheme

Senior Citizens Savings Scheme or SCSS is available to people above 60 years.

Contribution to the SCSS is tax-deductible up to Rs 1.5 lakh.

The rate for SCSS is higher than prevailing FD rates and is currently 8.7% (interest is taxable).

Return On Investment(ROI): Around 8%

Maximum Deduction: Rs. 1,50,000 (AY 2020-21)

Lock-in Period: 5 Years

National Pension System (NPS)

The National Pension System or NPS allows you to invest in equity and debt pension funds and build a retirement corpus.

After retirement, You can take withdraw a certain percentage of the corpus. As an NPS account holder, you will receive the remaining amount as a monthly pension post your retirement.

You Can Open an NPS Account with a bank or LIC or Directly online at NSDL.

This deduction under Section 80CCD(1B) up to Rs 50,000 is only available for contributions to the NPS.

Return On Investment(ROI): Around 8% – 14%

Maximum Deduction: Rs. 50,000 (AY 2020-21)

Lock-in Period: Till Age of 60

Life Insurance Premium

The annual premium paid for life insurance in the name of the taxpayer or the taxpayer’s wife and children is an eligible tax-saving payment under Section 80C of the Income Tax Act.

The deduction is valid only if the premium is less than 10% of the sum assured.

Payment of tuition fees

The tuition fee paid for the education of two children is eligible for tax deduction under Section 80C of the Income Tax Act.

The fee can be paid to any school, college, university or educational institute situated in India. The fees have to be for a full-time course only.

Home Loan Principal Payment

Home loan EMI has two-part, principal and interest.

The repayment of the principal of a loan taken to buy or construct a residential property is eligible for tax deductions under Section 80C of the Income Tax Act.

This deduction is also applicable on stamp duty, registration fees and transfer expenses.

Note: You Can Avail Maximum Tax benefit of up to Rs.1,50,000. It is Combined of All Investment Listed Below under this Section 80C Except National Pension System(NPS).

Want To Earn More Money? Check Out This Article on Different ways To Earn Money.

House Rent Allowance (HRA)

House Rent Allowance (HRA) is the amount that your employer pays you towards the rent of your accommodation.

Every salaried individual living in a rented flat is entitled to claim HRA to save on taxes.

HRA is regulated by the provisions of Section 10(13A) of the Income Tax Act.

A salaried individual can claim HRA exemptions only if these conditions are met:

- HRA is received as part of the salary package

- If an employee stays in a rented house

- Rent paid is more than 10% of the salary

Don’t forget to take rent receipts from your house owner.

You can also give rent to your parents. It would also work for tax saving.

Home Loan Interest Payment

Home loan interest payment enjoys separate tax saving.

The limit of deduction for home loan interest payment is ₹2.0 lacs.

This deduction can give you a very big tax saving. However, the loan amount should be big to get the full benefit.

Health Insurance Premium

Every individual can claim a deduction under Section 80D for their medical insurance which is taken from their total income in any given year.

An individual can claim a deduction of up to Rs 25,000 for the insurance of self, spouse, and dependent children.

An additional deduction for the insurance of parents is available to the extent of Rs 25,000 if they are less than 60 years of age, or Rs 50,000 (as per the Budget 2018) if your parents are aged above 60.

Health insurance is like “Ek Teer see Do Nishan“. You and Your Family Will be Protected and You can Save Income Tax on Your Salary.

Education Loan

Any individual who has applied for a loan for higher education can avail of the benefits of tax saving provided by Section 80E of the Income Tax Act, 1961.

Even if an individual has availed the maximum available deduction of INR. 1,50,000 under section 80C, they can still avail deduction under Section 80E.

The loan should be taken for the higher education of self, spouse or children or for a student for whom the individual is a legal guardian.

Parents can easily claim this deduction for the loan taken for the higher studies of their children.

Income Tax Deduction can be claimed only on the interest component.

Donations/Donations to Political Parties

You can save tax on your donations.

However, not every charity gives you 100% tax saving.

Donations to the PM relief fund, some notified NGO and political parties can give you the 100% tax benefit.

You can also donate to scientific institutions and religious body and claim a tax rebate.

Conclusion

There Are more ways to Save Income Tax On Your Salary.

If you Want to Save more tax then You Should Consult Your Charter Account or Financial Advisor.

Let Me Know in Comments if You Have any Question.