Compound interest is a very powerful thing that can grow your wealth exponentially.

Calculating compound interest can be hard sometimes so to make it easy some good folks came up with Rules of Compounding.

These rules make it stupidly simple to calculate what time it will take to double, triple or quadruple your investment with the help of compound interest.

As Albert Einstein said

Compound Interest Is the Eighth Wonder of the World. He Who Understands It Earns It… He Who Doesn’t… Pays It.

– Albert Einstein

So let’s learn about these rules of compounding…

Page Contents

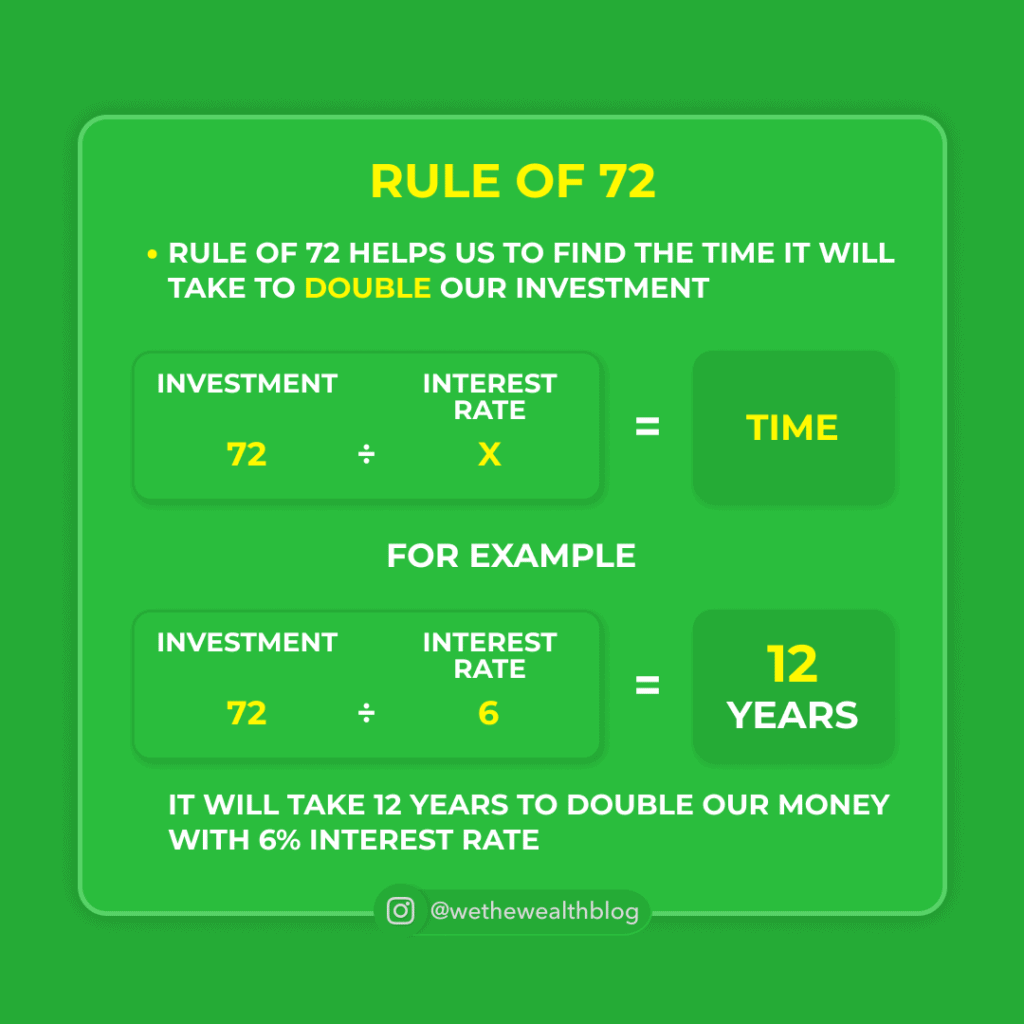

Rule of 72

The rule of 72 helps us to quickly calculate the time it will take to Double your investment. Let’s learn it by example.

For Example:

If your initial capital is ₹1,00,000 and the interest rate is 6% then the calculation will be like this

Initial Capital = ₹1,00,000

Interest Rate = 6%

Years to Double = 72 / 6= 12 Years

So if you invest ₹1,00,000 somewhere that gives you 6% interest it takes 12 years to double your money.

You can Also Use Our Compound Interest Calculator for Easy Calculations.

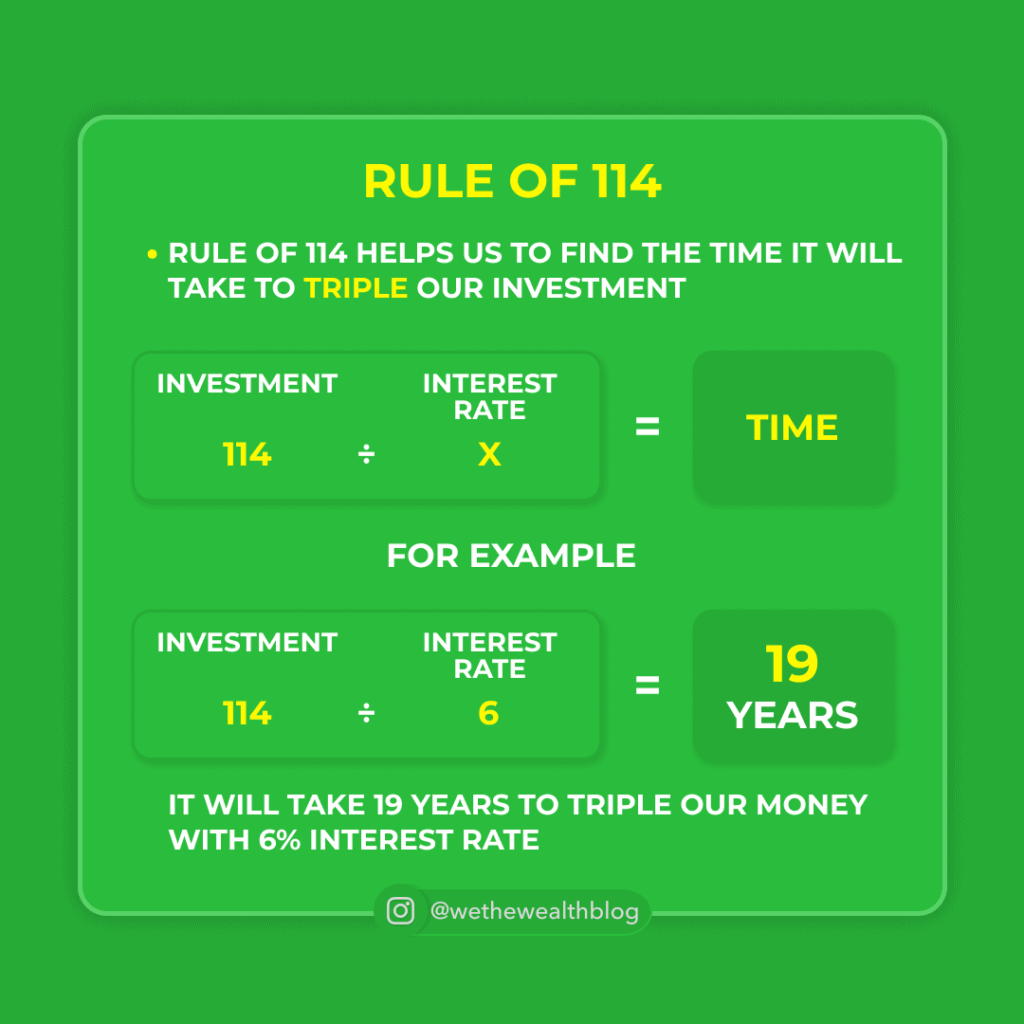

Rule of 114

As we have seen above, the rule of 72 helps to calculate time to Double your investment, in the same manner, the rule of 114 will help you to calculate time to triple your investment.

For Example:

If your initial capital is ₹1,00,000 and the interest rate is 6% then the calculation will be like this

Initial Capital = ₹1,00,000

Interest Rate = 6%

Years to Double = 114 / 6= 19 Years

So if you invest ₹1,00,000 somewhere that gives you 6% interest it takes 19 years to triple your money.

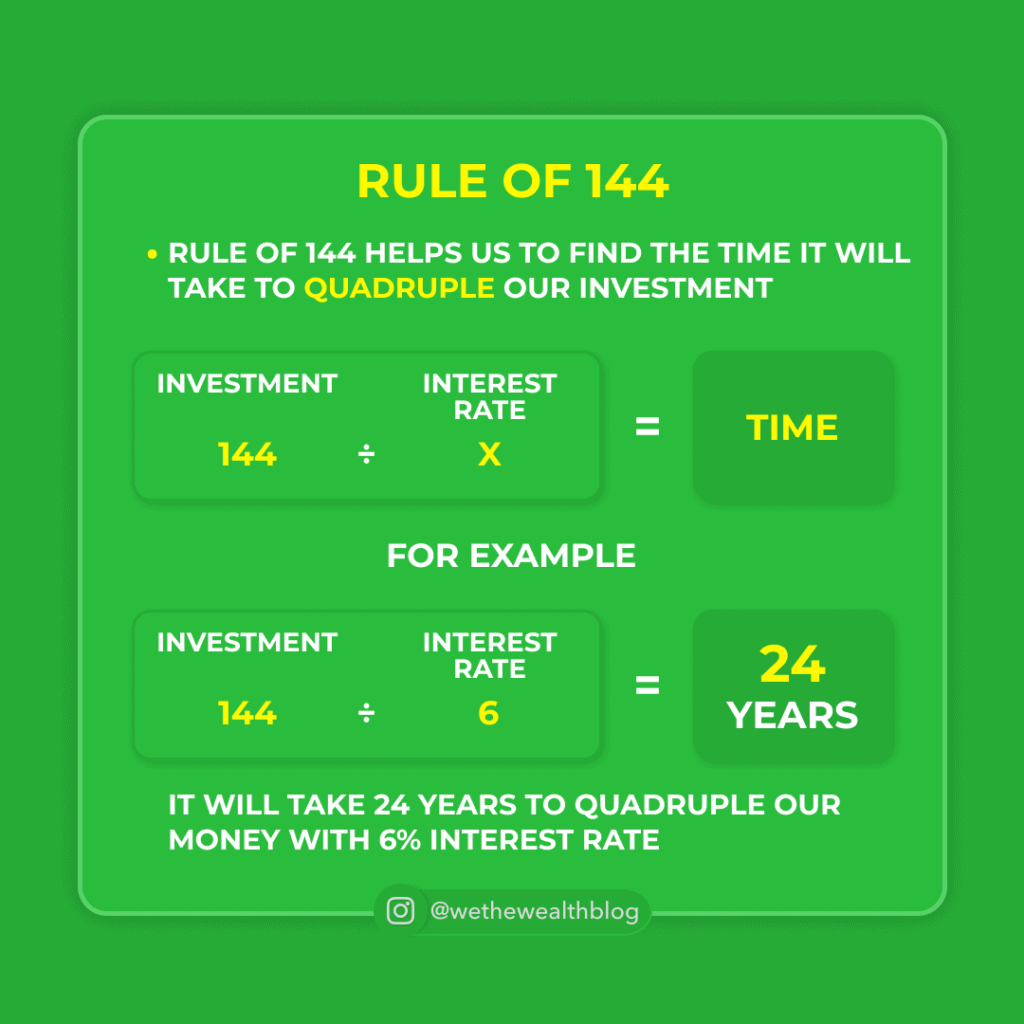

Rule of 144

Rule of 144 is used to calculate the time it will take to Quadruple(4 times) your initial investment.

For Example:

If your initial capital is ₹1,00,000 and the interest rate is 6% then the calculation will be like this

Initial Capital = ₹1,00,000

Interest Rate = 6%

Years to Double = 144 / 6= 24 Years

So if you invest ₹1,00,000 somewhere that gives you 6% interest it takes 24 years to quadruple your money.

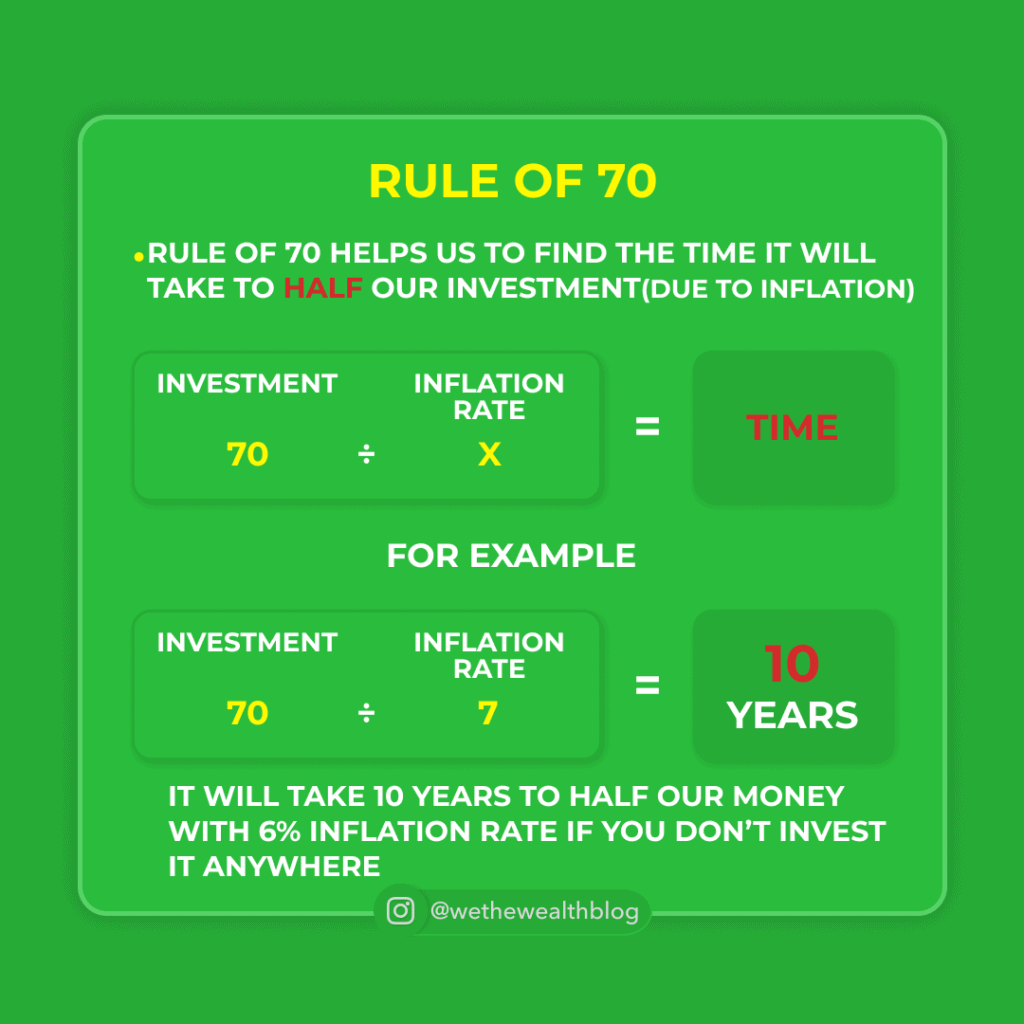

Rule of 70

Rule of 70 helps you to calculate inflation’s effect on your money.

For Example:

If your initial capital is ₹1,00,000 and the inflation rate is 7% then the calculation will be like this

Initial Capital = ₹1,00,000

Inflation Rate = 7%

Years to Half = 70 / 7= 10 Years

So if you don’t invest ₹1,00,000 somewhere then a 7% inflation rate will eat away your wealth in half in 24 years.

TIP: To protect your money, your rate of return should always be more than the rate of inflation.

To beat the effect of inflation on your capital, you need to invest your money where you will get more than a 6% return(Average Inflation Rate in India).

Check out Our Guide on How to Invest in Index Funds.

Conclusion

In conclusion, you need to get at least a 6% return on your investment to just beat inflation.

Let me know your thoughts on these 4 rules of compounding in comments.