You may have heard terms like credit score and credit report and thought that what is a credit score and how can you check yours. This is exactly what we are going to talk about today.

Banks and NBFC like financial institutions check credit score when you apply for any loan or Credit Card. You should keep a watch on your credit score so you are aware of what is reported on your credit score and can ask credit bureaus to change something if there is some error.

Let’s dive deep into it…

Page Contents

What Is Credit Score?

A credit score is a number that represents your credit report. The credit report is your report card that contains your history of loans and their repayment behaviour as well as your credit card repayment data.

Your credit score will be in the range of 300 to 900 and if your credit score is over 700 then you will be considered a creditworthy person and it will be easy for you to get new loans with low-interest rates or credit cards and if your score is lower than 600 than it will be hard for you to get new unsecured loans from any banks or NBFCs(non-banking financial company).

When you get a loan and you pay it on time then your credit score will increase and so does your creditworthiness.

Your credit score and credit reports are calculated and maintained by credit bureaus. There are multiple credit bureaus in India.

Credit Bureaus in India

Here Is a List of Credit Bureaus Registered in India.

- TransUnion CIBIL (Credit Information Bureau (India) Limited)

- CIBIL is the most popular, oldest and widely credit bureau and when someone refers to a credit score than most of the time they are talking about CIBIL Score.

- Experian

- CRIF High Mark

- Equifax

How Is Credit Score Calculated?

Your credit score is calculated by credit bureau with their proprietary methods and because of that, your credit score from the different credit bureau will be different.

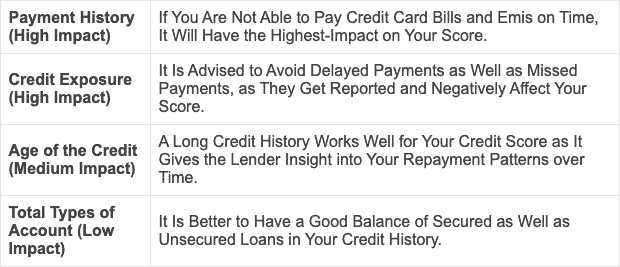

Credit bureau consider below things while calculating your credit score.

- Credit History: Your Credit History is the most important part of your Credit score calculation. CIBIL gives around 30% weightage to your Credit history. Your Credit History contains Different things like:

- Last 3 Years of the repayment history of both loan and credit cards.

- Age of Your credit history

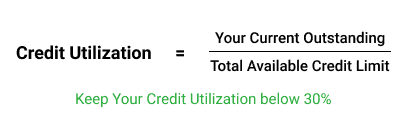

- Credit Utilization: A high credit utilization ratio may indicate banks that you use your credits extensively and can lower your credit score. CIBIL gives around 25% weightage to your Credit Utilization.

- How to Calculate Your Credit Utilization Ratio: Your current outstanding loan obligations divided by your available limit

- The mixture of Credits: Types of Loan are also an important part of your credit score. a Healthy mix of Secured and Unsecured loans will help you to get a better credit score. CIBIL gives around 25% weightage to your The mixture of Credits.

- the number of credit applications: Your total number of applications in recent times are also a thing credit bureaus will consider for your credit score.

- Write-offs: If you defaulted on any of your past loans or credit cards bills then that will hurt your credit score by a lot.

Four Main Factors and Their Impact on Your Credit Score👇🏻

Why Should You Check Your Latest Credit Score?

Checking your credit score before applying for any loan will give you an idea of will the bank approve your application or not.

A low score means that banks or NBFCs may not approve your application

Checking credit report gives you an idea of what is reported to credit bureaus and if you find some errors you can report them.

It will also give you month on monthly report on how your credit score improving.

Benefits of a Good Credit Score

A credit score above 750 is considered a good credit score.

So if your credit score is above 750 then you can get some extra benefits being a creditworthy person like:

- Pre-approved Offers: Banks May Give You Some Pre-approved Offers for Credit Cards and Loans for Maintaining a Good Score.

- Fast Loan Approval: Your Loan Approval Time Will Be Fast as You Have a Great Credit History.

- Low-Interest Rates: You Will Get Low Interest on Your Loan Applications.

- High Credit Cards Limits: Banks Will Give You High Limits on Your Credit Card.

How to Check Your Credit Score for Free

There are multiple ways to check your credit score (keep your Pan Card Number handy). Here are some apps and websites where you can check your credit score.

- CIBIL – Only 1 Free Report per Year

- OneScore (App)

- IndWealth (App)

- Paytm (App)

- Paisabazaar

- Cred (App)

- Wishfin

- IMPORTANT: While registering on the wishfin site above, please “ un-check” the option that says “ no thanks. I’m only interested in checking my cibil score.” Because you don’t want to be disturbed with the unwanted telemarketing calls…

Note: Checking your credit score will not hurt your credit score.

How to Check Your Business Credit Score for Free

If you want to check the credit score of your business just enter your company’s information instead of your personal information.

A business credit score is required if you want to apply for a loan on behalf of your business.

Credit Score Required for Different Loans in India

| Loan Type | Good Credit Score |

| Home Loan | Above 650 |

| Personal Loan | Above 700 |

| Loan against Property | Above 650 |

| Business Loan | Above 700 |

| Car Loan | Above 700 |

| Gold Loan | Not Required |

How to Improve Your Credit Score

If you don’t have a loan or credit card, then your credit score will be zero.

Take a secured credit card and pay your bills in time and in 6-12 month your credit score will improve.

If you have a low credit score then follow these tips to improve your credit score:

- Make timely & regular Payments

- Only use Up to 30% of your Credit limit on your Credit cards

- Do not apply for multiple loans in a short period of time.

- Never Default on your Payments

- Keep using your Oldest Credit Card.

- Maintain a Good Mixture of Credits(Secured & Unsecured)

- If you find Any Error, report it to that Credit Bureau.

It can take up to 12 months to improve your score if you take the right steps so be patient.

Conclusion

As you have learned that credit score is an important metric of financial health. So be a responsible person and keep checking your credit score and try to improve it.

If you have any questions please let me know in the comments.