So let’s say your career just started or your income is less than ₹2.5 lakhs per annum or you resigned from your job or unfortunately, you lost your job.

Then a question will come to your mind that is it necessary to file an income tax return? or why should I file a nil/zero income tax return, and if I need to file ITR then how can I do it?.

That’s what we age going to discuss today. So let’s get started.

Page Contents

What Is a Nil/ Zero Income Tax Return?

A NIL/Zero income tax return is filed to show the income tax department that you fall below the taxable income and do not need to pay taxes this year.

Why Should You Need to File Zero Income Tax Return

Here are 3 reasons why you should do it:

- As Your Income Proof: When you go to apply for a loan, you will need to show some proof of your income and your income tax return will serve as your income proof. It will also help when you file an application for a passport or visa.

- To Claim a TDS Refund: Sometimes bank deducts TDS(tax deducted at source) on interest earned over ₹ 10,000. Interest can be in your saving accounts or any deposits with your bank. So if you are below the taxable income limit then you can file a nil income tax return to get a refund of that tds.

- To Carry Forward Your Losses: If you are an investor or trader in the stock market and if you face some loss then you can balance that against your gains with your income tax return.

Is It Compulsory to File Nil/Zero Income Tax Return as an Individual?

If your income is more than ₹2,50,000 then yes, it is compulsory to file an income tax return. You can claim Some Deduction To keep your income below the taxable limit.

And if your income is less than ₹2,50,000 then it is not compulsory to file an income tax return but it is good practice to file it. I recommend that you file an income tax return as there are great benefits to do so.

Do I Have to File Nil Income Tax Return for a Company?

Yes, you have to file a Nil return for your company, even if there is no revenue or activity in the company.

How to File File Nil Income Tax Return/Zero Income Tax Return?

The process of filling Nil ITR is the same as filing a regular ITR. You can file nil ITR online through e-filing. And you can also e-file your itr using the upload xml method.

Requirements:

- Pan Card

- Aadhar Card

- Bank Account Details and Interest Details

- Salary Details, Form 16

- Investment Details (If Any)

- Create Your Account If You Don’t Have It at Income Tax Department Website.

How to File File Nil / Zero Income Tax Return Online?

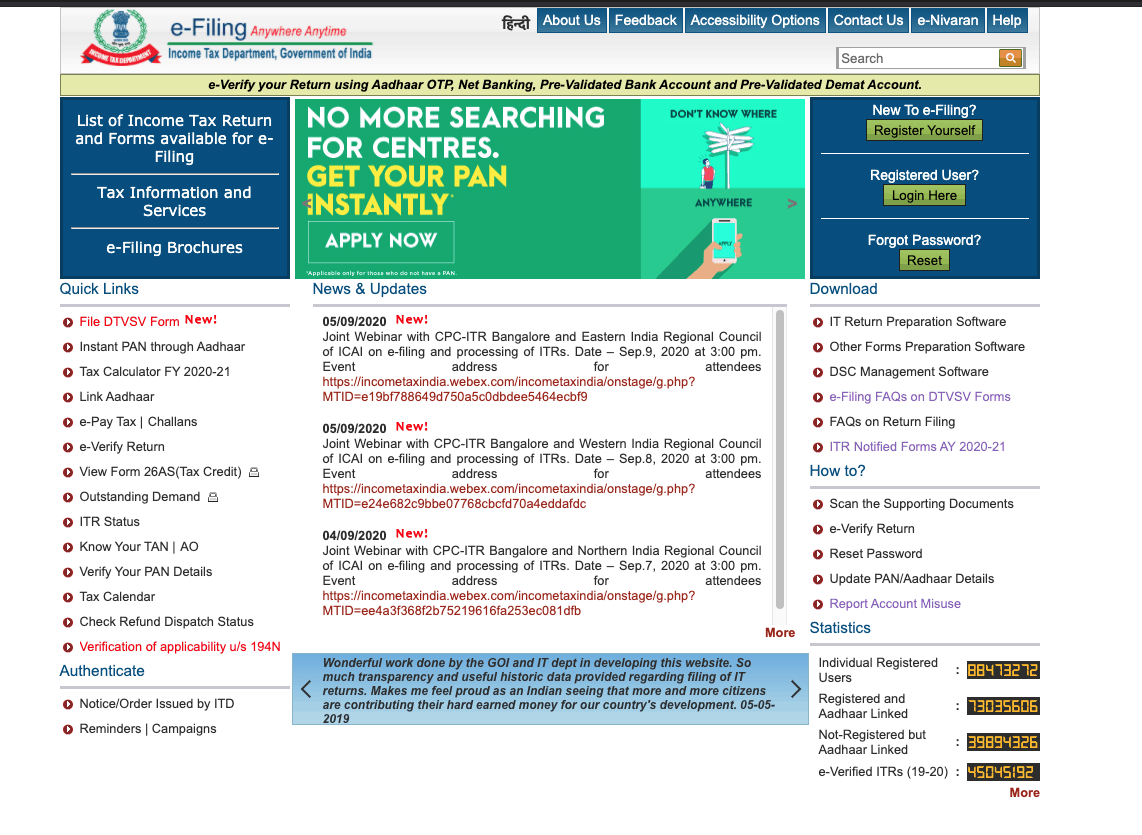

- Go to the Income Tax e-Filing portal, https://www.incometax.gov.in/iec/foportal/

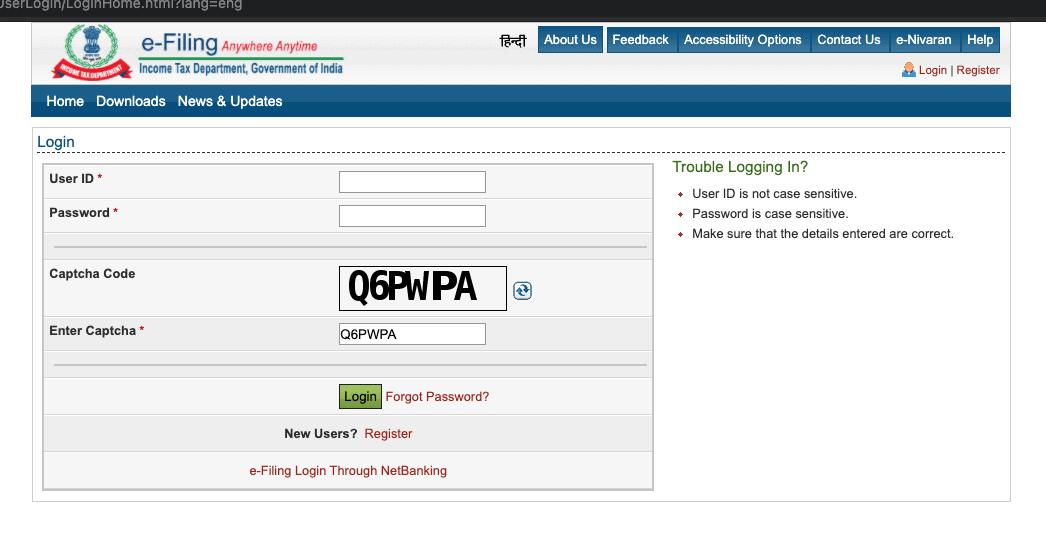

- Login to e-Filing portal by entering user ID (PAN), Password, Captcha code and click ‘Login’.

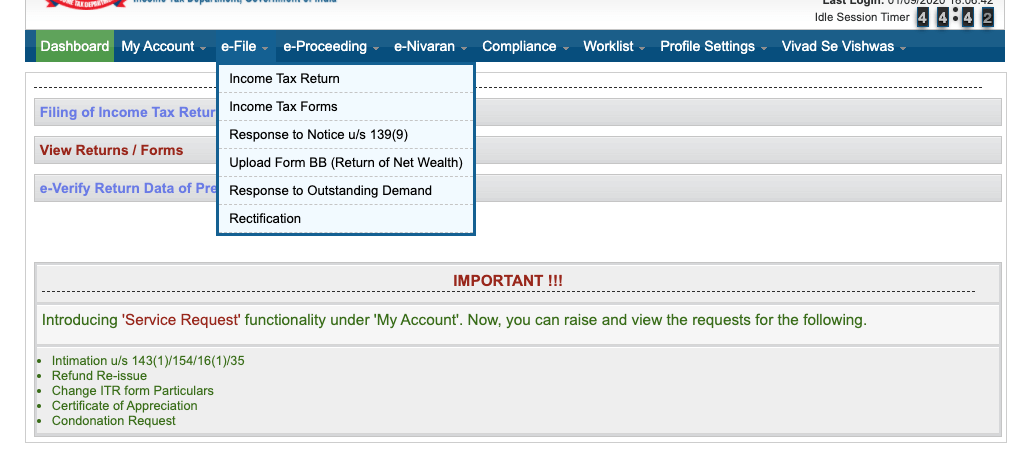

- Click on the ‘e-File’ menu and click ‘Income Tax Return’ link.

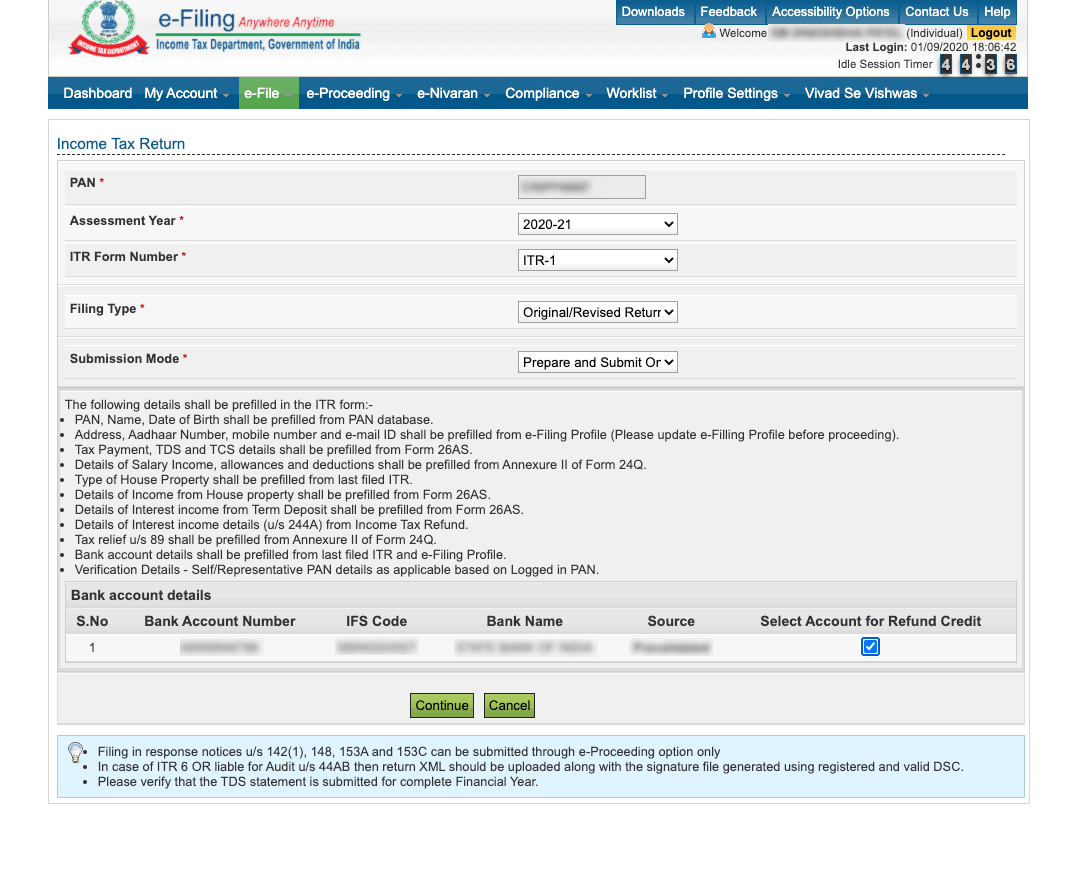

- On Income Tax Return Page:

- PAN will be auto-populated

- Select ‘Assessment Year’

- Select ‘ITR Form Number’

- Select ‘Filing Type’ as ‘Original/Revised Return’

- Select ‘Submission Mode’ as ‘Prepare and Submit Online’

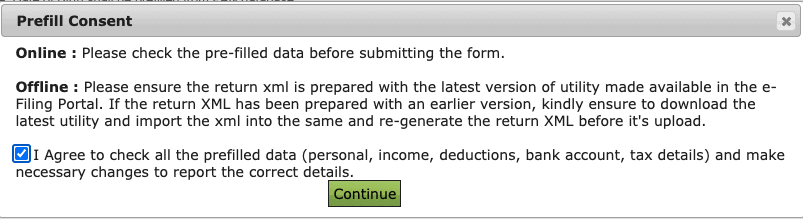

- Click on ‘Continue’

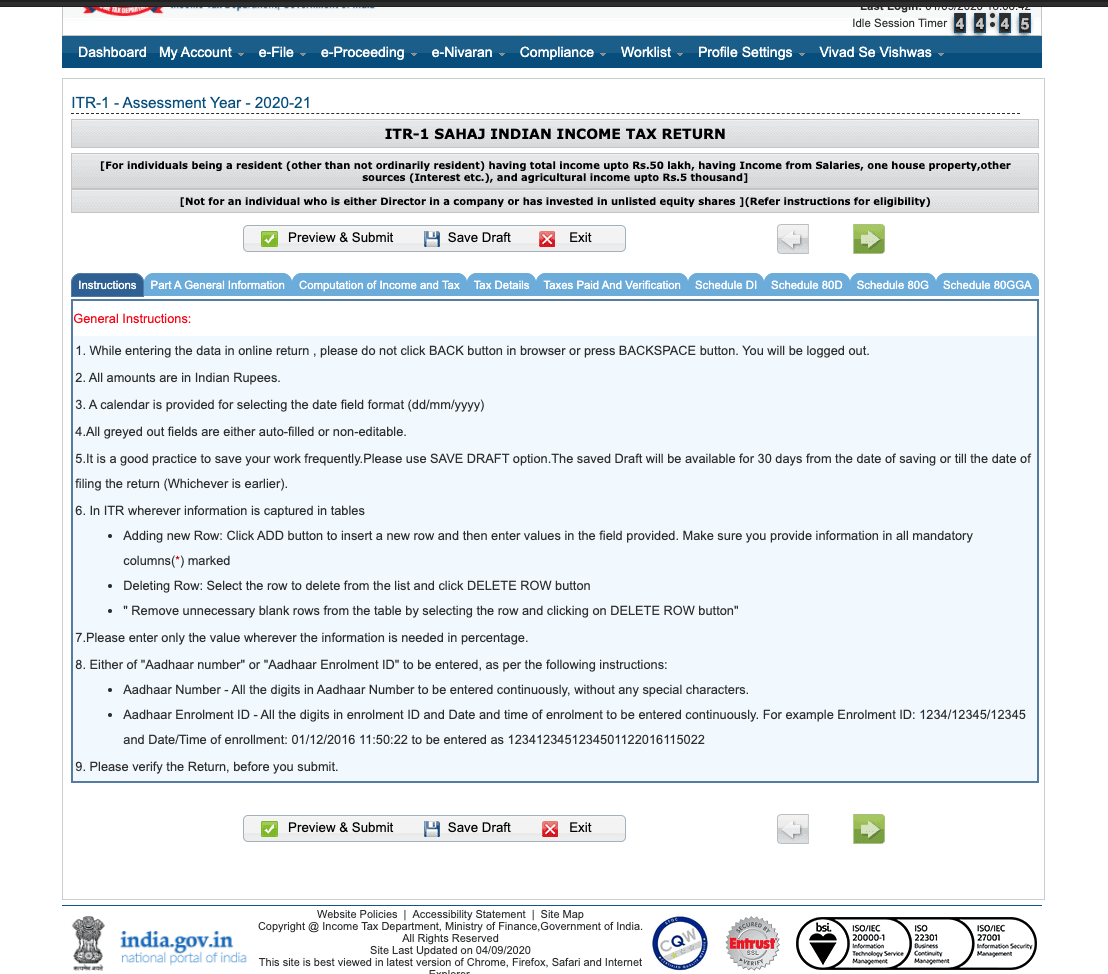

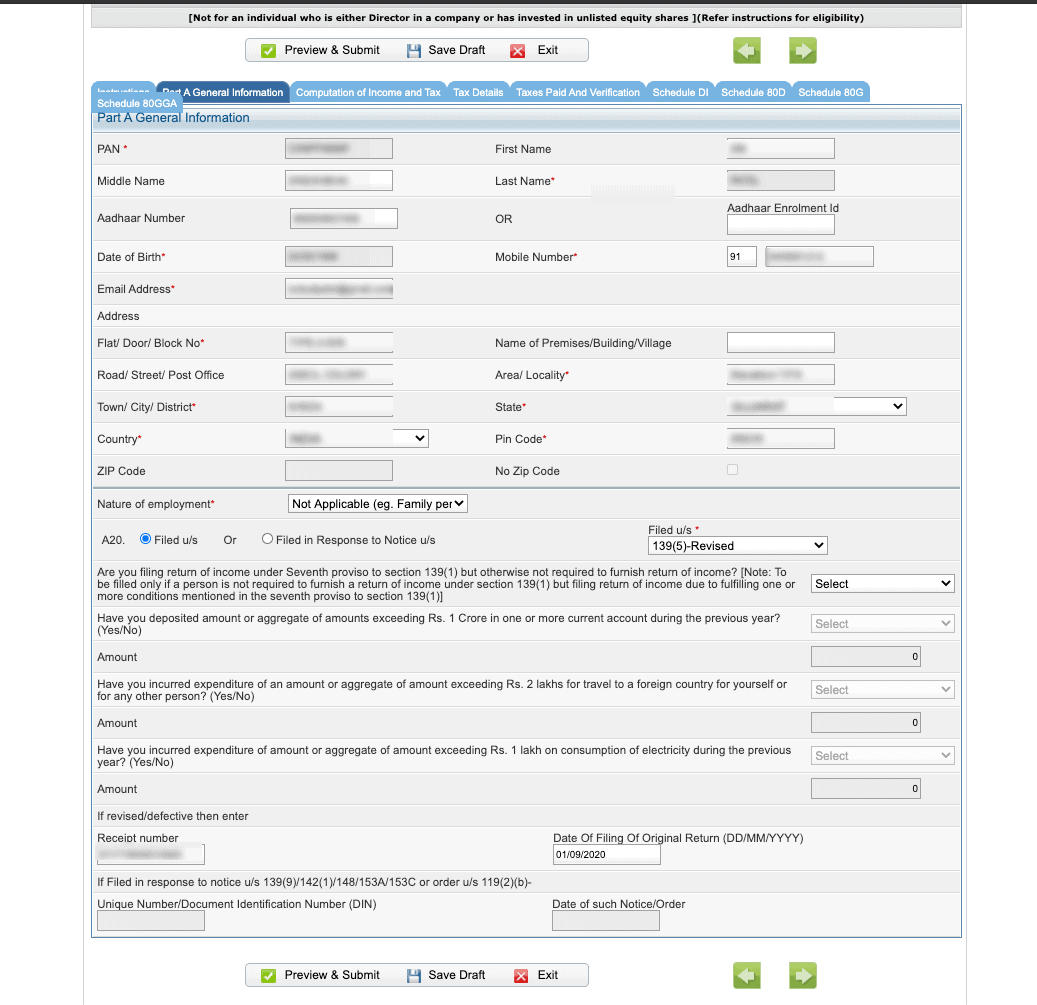

- Read the instructions carefully.

- Fill all the applicable and mandatory fields of the Online ITR Form.

- Note: To avoid loss of data/rework due session time out, Click on the ‘Save Draft’ button periodically to save the entered ITR details as a draft. The saved draft will be available for 30 days from the date of saving or till the date of filing the return or till there is no change in the XML schema of the notified ITR (Whichever is earlier).

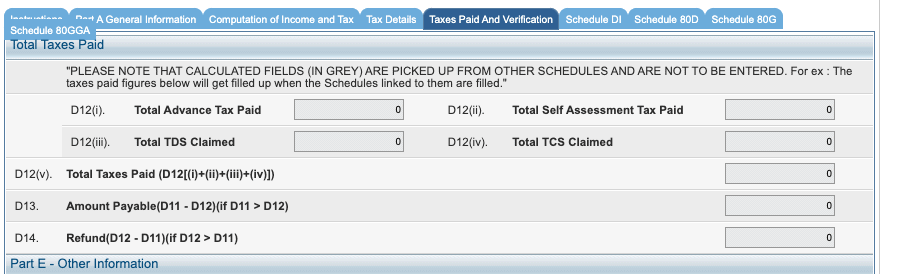

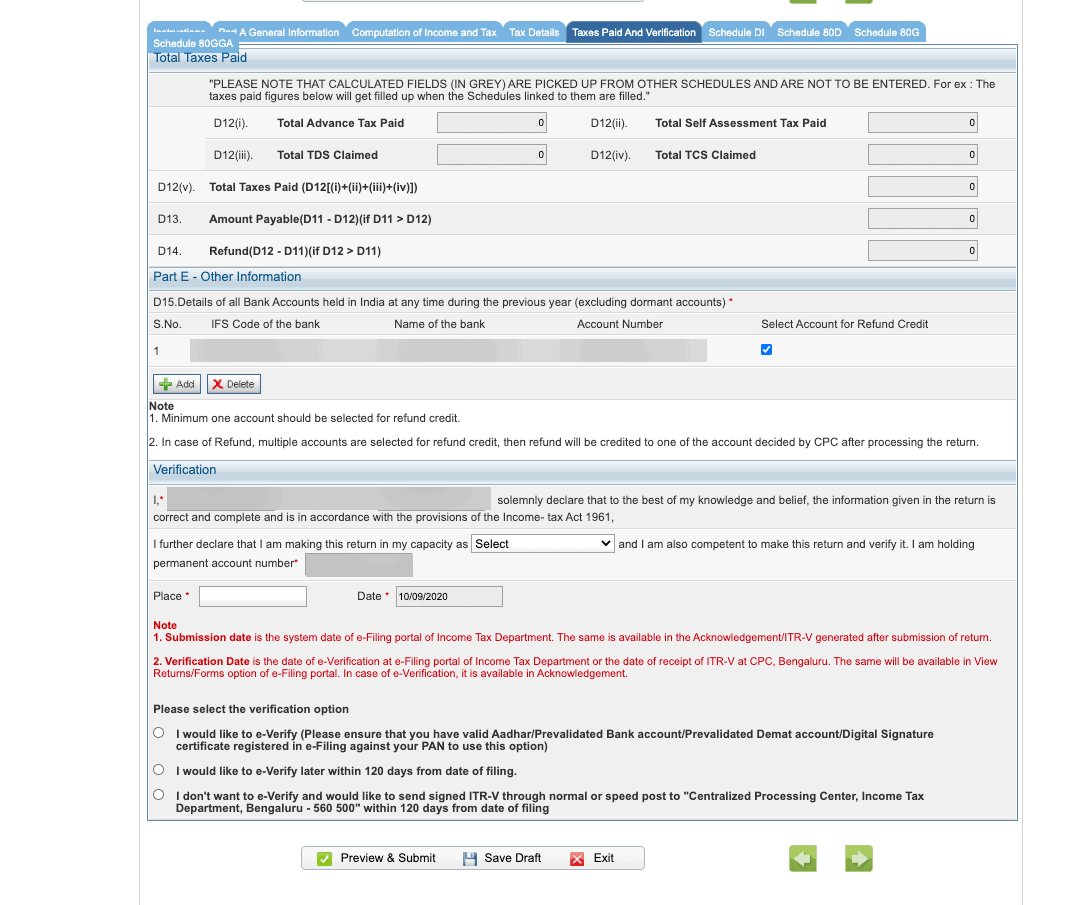

- If You Filled Everything Correctly Your Amount Payable will show 0 on ‘Taxes Paid and Verification’ tab.

- Choose the appropriate Verification option in the ‘Taxes Paid and Verification’ tab.

Choose any one of the following option to verify the Income Tax Return:- I would like to e-Verify

- I would like to e-Verify later within 120 days from the date of filing.

- I don’t want to e-Verify and would like to send signed ITR-V through normal or speed post to “Centralized Processing Center, Income Tax Department, Bengaluru – 560 500” within 120 days from date of filing.

- Click on the ‘Preview and Submit’ button, Verify all the data entered in the ITR.

- ‘Submit’ the ITR.

- On Choosing ‘I would like to e-Verify’ option, e-Verification can be done through any of the following methods by entering the EVC/OTP when asked for.

- EVC generated through bank ATM or Generate EVC option under My Account

- Aadhaar OTP

- Prevalidated Bank Account

- Prevalidated Demat Account

- Note: Choosing the other two verification options, the ITR will be submitted but the process of filing the ITRs is not complete until it is verified. The submitted ITR should be e-Verified later by using the ‘My Account > e-Verify Return’ option or the signed ITR-V should be sent to CPC, Bengaluru.

- The EVC/OTP should be entered within 60 seconds else, the Income Tax Return (ITR) will be auto-submitted. The submitted ITR should be verified later by using the ‘My Account > e-Verify Return’ option or by sending signed ITR-V to CPC.

- On Choosing ‘I would like to e-Verify’ option, e-Verification can be done through any of the following methods by entering the EVC/OTP when asked for.

- Verify Your E-Return And It’s Done.

How to File File Nil / Zero Income Tax Return Offline?

To E-file the Itr Using the Upload Xml Method, the User Must Download either of the Following Itr Utility:

- Excel Utility

- Java Utility

Perform the following steps to download the Java Utility or Excel Utility, then to generate and Upload the XML:

- Go to the Income Tax e-Filing portal https://www.incometax.gov.in/iec/foportal/

- Download the Appropriate ITR utility under ‘Downloads > IT Return Preparation Software’.

- Extract the downloaded utility ZIP file and Open the Utility from the extracted folder. (For more information and prerequisites, refer the ‘Read me’ document).

Note: System Requirements

Excel Utilities: Macro enabled MS-Office Excel version 2007/2010/2013 on Microsoft Windows 7 / 8 /10 with .Net Framework (3.5 & above)

Java Utilities: Microsoft Windows 7/8/10, Linux and Mac OS 10.x with JRE (Java Runtime Environment) Version 8 with latest updates.

To Enable Macros in Excel Go to > File > Options > Trust Centre > Trust Centre Settings > Macro Settings > Enable All Macro > Click ‘OK’ button twice to save these settings. - Fill the applicable and mandatory fields of the ITR form.

Note :

Pre-filled XML can be downloaded post login to the e-Filing portal from ‘My Account > Download Pre-Filled XML’ and can be imported to the utility for prefilling the personal and other available details. - Validate all the tabs of the ITR form and Calculate the Tax.

- Generate and Save the XML.

- Login to the e-Filing portal by entering user ID (PAN), Password, Captcha code and click ‘Login’.

- Click on the ‘e-File’ menu and click the ‘Income Tax Return’ link.

- On Income Tax Return Page:

- PAN will be auto-populated

- Select ‘Assessment Year’

- Select ‘ITR form Number’

- Select ‘Filing Type’ as ‘Original/Revised Return’

- Select ‘Submission Mode’ as ‘Upload XML’

- Choose any one of the following option to verify the Income Tax Return:

- Digital Signature Certificate (DSC).

- Aadhaar OTP.

- EVC using Prevalidated Bank Account Details.

- EVC using Prevalidated Demat Account Details.

- Already generated EVC through My Account Generate EVC Option or Bank ATM. The validity of such EVC is 72 hours from the time of generation.

- I would like to e-Verify later. Please remind me.

- I don’t want to e-verify this Income Tax Return and would like to send signed ITR-V through normal or speed post to “Centralized Processing Center, Income Tax Department, Bengaluru – 560500”

- Click ‘Continue’

- Attach the ITR XML file.

On choosing,- DSC as verification option, Attach the signature file generated from DSC management utility.

- Aadhaar OTP as verification option, Enter the Aadhaar OTP received in the mobile number registered with UIDAI.

- EVC through Bank account, Demat account or Bank ATM as verification option, Enter the EVC received in the mobile number registered with Bank or Demat Account respectively.

- Other two verification options, the ITR will be submitted but the process of filing the ITRs is not complete until it is verified. The submitted ITR should be e-Verified later by using the ‘My Account > e-Verify Return’ option or the signed ITR-V should be sent to CPC, Bengaluru.

- Submit the ITR.

How to Download ITR Acknowledgement

- Go to the Income Tax e-Filing portal, https://www.incometax.gov.in/iec/foportal/

- Login to e-Filing portal by entering user ID (PAN), Password, Captcha code and click ‘Login’.

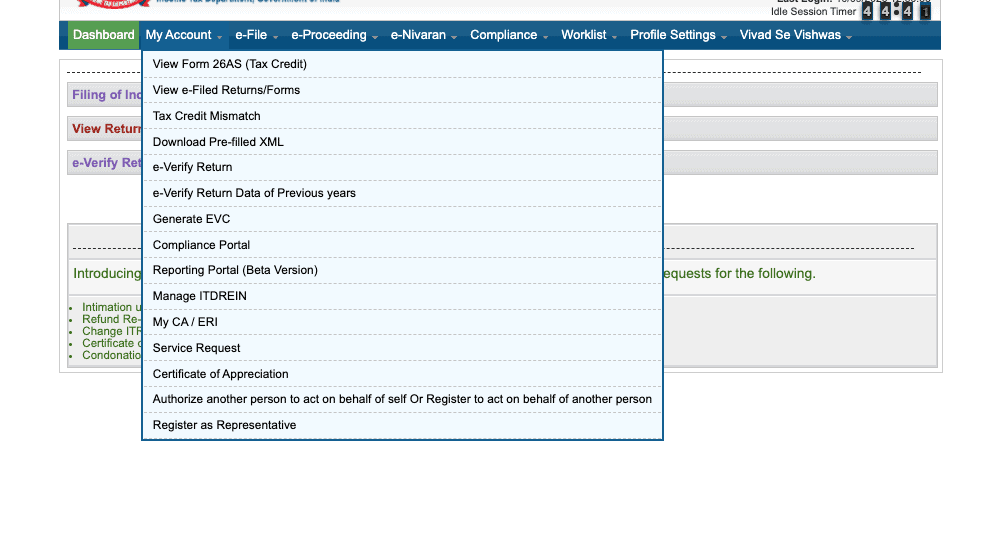

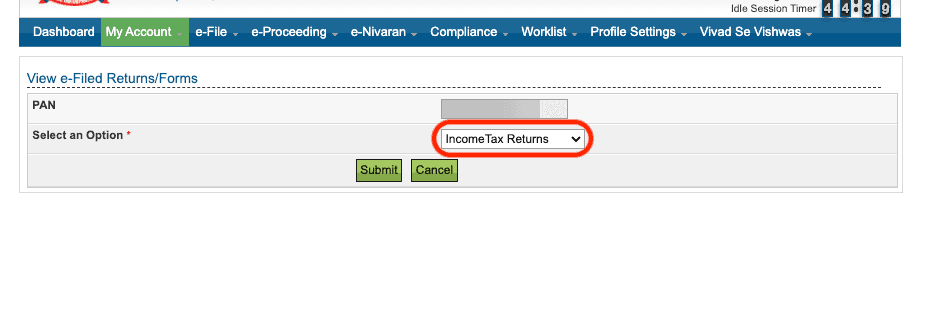

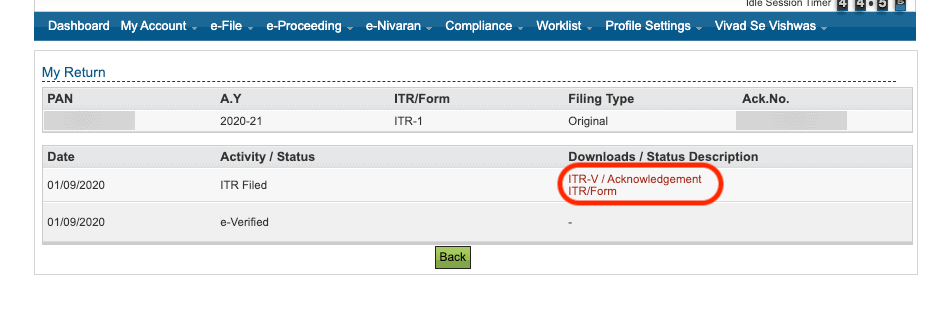

- Click on the ‘My Account’ menu and click ‘View e-Filed Return/Forms’ link.

- PAN will be auto-populated. Select Income Tax Returns From The Dropdown.

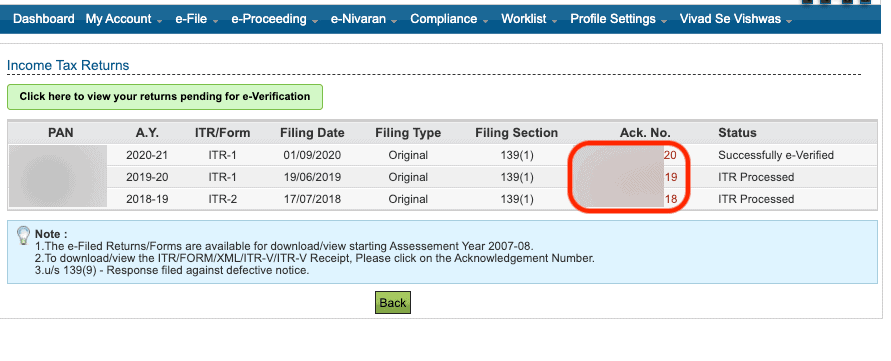

- Click On the Acknowledgement Number of Desired Year.

- Select “ITR-V/ Acknowledgement” From Download Section for ITR Acknowledgement and “ITR/Forms” to Download Your Filed Income Tax Return.

Conclusion

So if you are thinking that your income is below the tax limit and you don’t want to file an income tax return then by now you should change that and file your nil income tax right now as there are more advantages to do so. And don’t make excuse like “it’s hard” as I have shown you detailed step by step guides.

If you have any question or facing any problem then ask me in the comment section below.